Top 5 Canadian Credit Cards You Should Have

Credit cards have worked their way into society. While many believe they’re not a necessity, some consider them absolutely critical. However, credit and credit cards are absolutely necessary when wanting to pursue certain opportunities. For example, if you’re looking for a new car or house. One of the main factors that banks look at is your credit rating. If you have a good credit rating, it shows the bank that you’re low risk and reliable. This means the likelihood of you paying back the money owed is higher. Therefore, they will impose fewer interests and be more flexible. Credit cards are a tool that should be used to build your credit.

While credit cards can be devastating, if used incorrectly, there are many ways to use them correctly. One common question people ask is, which credit card is the best? There is no black and white answer. However, there are many credit cards that do stand out from the rest. Therefore, we will take a look at the top 5 credit cards, in no particular order.

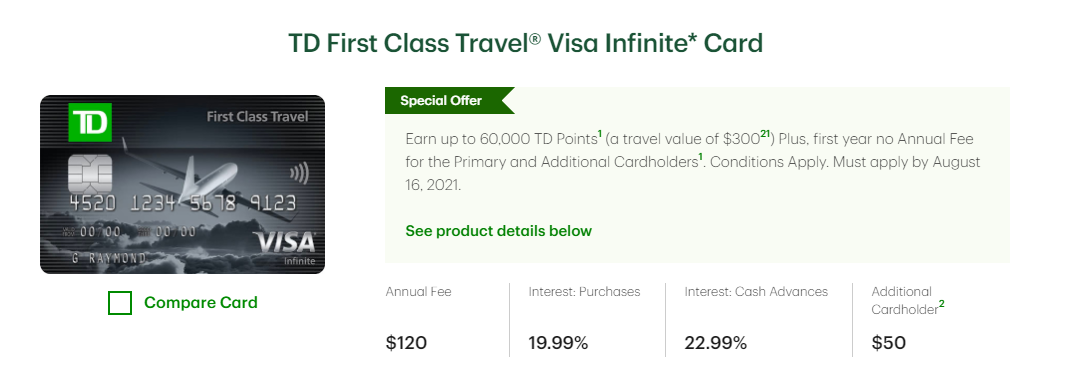

TD First Class Travel Infinite Card

First on our list is the TD First Class Travel Visa Infinite Card! This is card is excellent for those who tend to travel a lot. There are many reasons why it’s such a great card. First, you accumulate points faster than most other cards on the TD roster. Earning 3 points per $1 spent means that you’ll be able to take that trip you’ve been planning while making the same everyday purchases. However, if you were to make travel purchases through Expedia, you’ll earn 9 points for every $1! Like most premium cards, this one comes with a fee. The current fee is $120.

The interest rates are generally the same as any other premium card you’ll find. However, TD is offering $80,000 bonus points (as seen in the picture), along with the $120 rebate! The first 20,000 ($100 value) get sent to you just for opening up the credit card. 40,000 points when you spend $2,000 within 90 days. Lastly, you’ll receive a final 20,000 points for spending a total of $10,000 within a 12 month period! Remember, the point of credit card churning is to accumulate points and gain signup bonuses through purchases that you would otherwise make on your debit card. Therefore, don’t overspend or purchase items just to reach the sign-up bonus threshold!

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- From Hello To Hired: Breaking Through The Interview

- How To Start Your Very Own Blog!

- Marketing And Monetizing Your Blog

- 5 Unusual Jobs That You’ve Never Heard Of

- Keeping Your Credit Card Information Safe

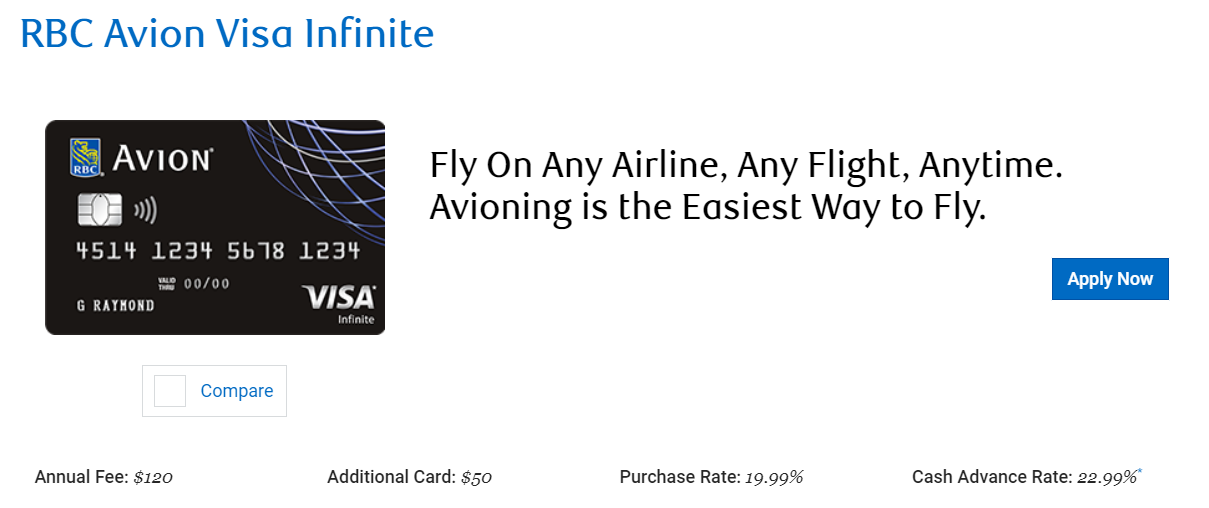

RBC Infinite Avion

Next up, the RBC Infinite Avion! One of the most recognizable and trusted credit cards that you can find! The Avion, like other cards, allows you to garner points while spending, 1 point for every $1 to be exact. The card also comes with a $120 annual fee rebate as well. You may be thinking this doesn’t sound too special. However, we put this card on this list for a few other reasons. First, you get a bonus of 35,000 points ($750 value) for signing up.

Also, the card comes with a slew of benefits that can be used for flying. For example, if the card is used to pay for a flight in its entirety, the main cardholder has medical coverage for a certain amount of days while traveling. Second, RBC has partnered up with Petro Canada When you purchase gas from any Petro Canada pump, three things will happen. You’ll save 3 cents per liter, gain 20% more Petro and RBC rewards points! Furthermore, any purchases towards travel give you an additional 0.25 (1.25 = $1) more points per dollar!

Definitely a card worth checking out!

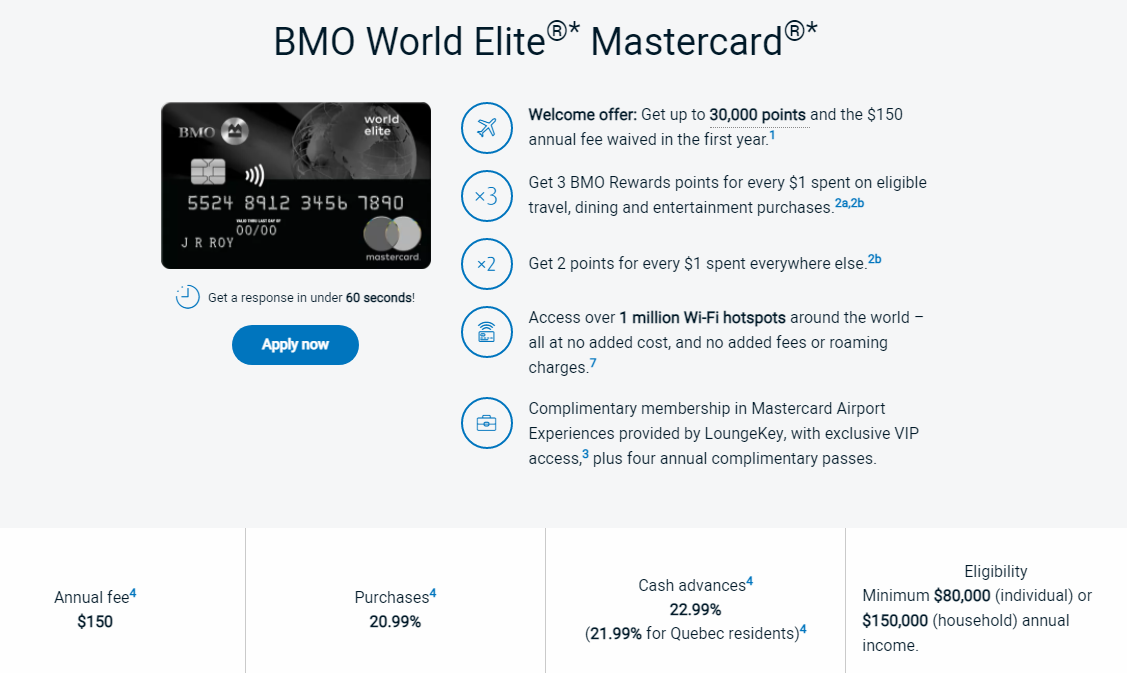

BMO World Elite Mastercard

Next on your list, the BMO World Elite Card. This card has a sleek, all-black design, which I personally enjoy. However, this card has more than just looks. This card possibly offers more value than the previous two cards mentioned! The interest rate stays the same. However, the annual fee is a bit more expensive, $150. This might be a deal-breaker to some but the benefits more than compensate.

The card boasts a 30,000 point welcome bonus for just signing up, which beats out the previous two cards. The annual fee is also rebated which means you get that extra value back into your pocket! Another great benefit is that you’ll have a free membership to Mastercard’s Airport Experience which is a chain of lounges that are available to premium cardholders. In order to actually access the lounges, you’ll need a pass. However, you’ll be provided with 4 complimentary passes for just owning the card as well!

Now, let’s get onto how you accumulate points. Fortunately, BMO offers a consistent way to earn points. You can get 3 points for $1 spent on travel, dining, and entertainment. Every other purchase earns you 2 points! Like the Avion, this card has travel medical insurance and no blackout dates when booking travel with your points!

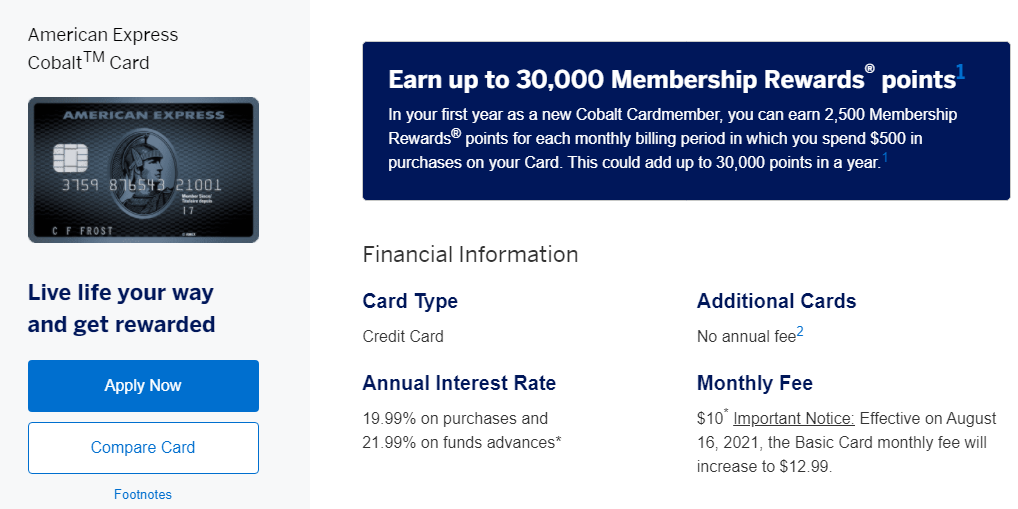

American Express Cobalt Card

The American Express Cobalt is another great card! This card has a lot of great benefits to offer those who choose to acquire it! One great aspect of this card is that anyone can get it! A lot of times, banks require the customer to meet a certain income threshold, but not this card. With an annual fee of $120, this card is right up there with the premium fees. However, it does not seem like there is any promotion where you will get that $120 rebated.

Although not getting your annual fee rebated can be a turn-off, they do allow their customers to gain points throughout the year! Every month, if you spend $500 (minimum), you’ll receive an additional 2,500 points (for 12 months = 30,000 total)! This is great because the threshold for $500 can be easier to reach than $2,000 in three months. Most other cards also charge for additional cards that are added to the account. However, the American Express Cobalt offers free additional cards!

Lastly, the rewards program offers 5 points for every $1 spent on eligible eats and drinks, 2 points for every $1 on travel, and 1 point for all other purchases!

This card is great for those who have a relatively low spending limit per month and require additional cards.

Tangerine Cashback Credit Card

We’ve been taking a look at a lot of premium cards. However, those can be expensive and many people don’t travel. For those who fit into this criteria, the Tangerine Money-Back may be the card for you! This card is great and should be in everyone’s wallet, even if you own a premium credit card already!

This card has no fees, no limits on your cashback and you’re able to organize and track your spending! The card offers 2% cash back on purchases within the 2 (of your choice) “2% money-back categories” and 0.50 % on everything else! Another really amazing feature about this card that many other cash-back programs lack

is earning deposits. The cashback is able to be paid out to you and inserted directly into your Tangerine savings account! f you were to opt-in for this, you could earn cashback on 3 categories instead of 2!

These 2% cashback categories are grocery, furniture, restaurants, hotel-motel, gas, recurring bill payments, drug store, home improvement, entertainment, public transportation, and parking. Therefore, there are a lot of ways for your to receive cashback.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.