Bondster: The P2P Platform That You Should Be Using

This article is brought to you by Bondster.com.

Investing is an integral part of financial freedom. However, not everyone is aware of the many options that are available when looking to invest. From stocks to real estate, there are many assets that make up a well-diversified portfolio. One form of investment that many people don’t know about is peer 2 peer lending. Without going into too much detail, P2P lending is a way to earn interest on your initial investment. A long-term investment. Therefore, within this article, we will explain what P2P lending is, how it works, what Bondster is, and why its useful.

What Is P2P Lending

Peer 2 Peer lending is a form of investment. It is an investment platform where companies seek loans. They do this by signing up with a marketplace (such as Bondster). Once they’ve registered, they apply for a loan. This loan is then granted to the applicant (by the provider). However, this is not where the process stops. On the other side, there are investors who are eager to invest their money. Therefore, they invest in the loan with the agreement to get a certain amount of money back in interest. For example, you can invest 1,000 Euros. However, you’re investing in a 5-year loan. This means every month you’ll get a certain principle amount back plus interest. If you were to actually give an example with numbers. A 1,000 Euros investment with a 5-year return would get you back 16 Euros a month in just principle.

The amount of interest you get back can vary. This depends on the type of loan, risk, amount, etc. Therefore, it is not uncommon to see loans that offer an annual return of 10%. This is more than most investments out there such as many ETFs and high-interest savings accounts. However, there are some investments that offer more than 10%. I’ve seen one that was offering a 17% return. While this might be appealing, you need to be careful.

Many of these high-reward investments are also extremely high risk. That means that there will be a higher chance that the loan will default and you’ll lose your money. However, some people don’t mind this risk. They see it as a necessary option when wanting to earn more money and I can definitely see why. If you’re one of these people, those high-risk/reward options may be exactly what you’re looking for. Just be wary of who you invest your money into.

Related Articles

- From Hello To Hired: Breaking Through The Interview

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- 10 Most Woman-Dominated Industries

What Is Bondster

Bondster is one of the fastest-growing fintech companies in the field of P2P (Peer-to-Peer) loan marketplaces in Europe and the very first online investment platform of its kind in the Czech Republic. Bondster is an online investment platform that connects providers of loans with retail investors. Investors (individuals or companies) may invest their free funds into loans already provided by different providers and benefit from double-digit interest in EUR or CZK.

Investors can choose from different types of loans, maturity, security, providers, and their country of origin. Furthermore, they can also see the repayment history of the debtor to whom the loan had been provided and they can also see the basic information about the debtor.

A bit more about Bondster is that they are a Europian based company, Czech to be more exact. Furthermore, the whole website is in Euros. Therefore, the currency that you’d need to convert to is Euros.

They’re one of the fastest financial tech companies that are only gaining momentum as they progress. However, there is someone who can explain what, the CEO of Bondster. Below will be a relatively short explanation directly from the CEO.

If you want to learn more about Bondster, who they are, and what they have to offer in greater detail, you can visit their website here.

Why Is Bondster Worth It?

Onto the main point of the article, why is Bondster worth it? There are many reasons why Bondster is an amazing option for anyone looking to find a P2P lending marketplace. First, signing up for Bondster doesn’t take a long time. Signing up can take as little as 5 minutes.

Next is the fact that they have an investment calculator. It gives you an approximation of how much you’ll earn on your investment over a set amount of years. For example. if you insert 500 Euros and let it sit for 1 year, you’ll get a return that is around 553 Euros. Approximately a 10% annual return. However, you can earn 13% and in some cases as much as 15%. Therefore, Bondster offers a high annual return.

Bondster also offers an opportunity for a wide variety of investments such as loans, securities, etc. Therefore, you don’t have to choose just one investment option.

Bondster offers highly trusted investments through various providers. This means that there is a high chance that you’ll get your investment back. Therefore, the chance of your investment defaulting and losing your money is low. This is due to the fact that many of their investments are secured.

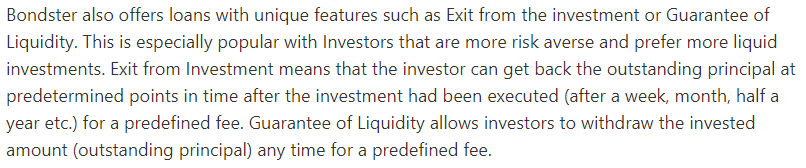

One of the most appealing features that Bondster offers is both Guarantees of Liquidity and Exit From the Investment.

To make it easy for you, the reader above is a direct passage that explains exactly what both of these features do. As you can see they’re highly advantageous and make investing a lot more risk-free. However, the only disadvantage is that there is a predetermined fee. The predetermined fee, however, can be seen as a minor price to pay in exchange for freedom and flexibility.

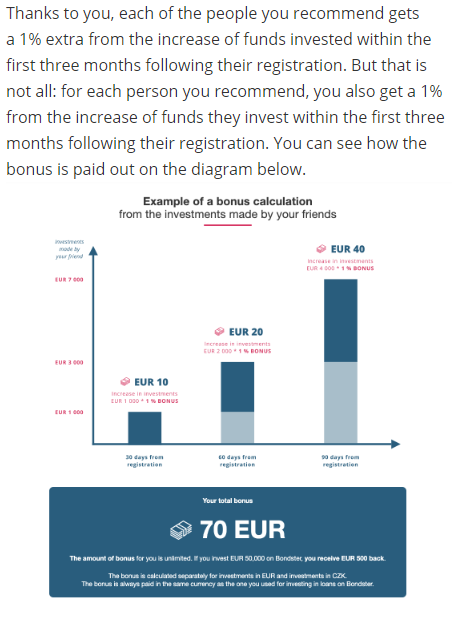

The next benefit that many people enjoy about Bondster is that they have a loyalty program.

This is an amazing way to receive essentially free money. Referring people to Bondster will not only benefit you but the other person greatly. Depending on the amount you initially invest, 1% can be a large amount. An additional 500 Euros is nothing to take lightly. Therefore, if you’re signed up with Bondster, you should try your best to invite as many people as possible.

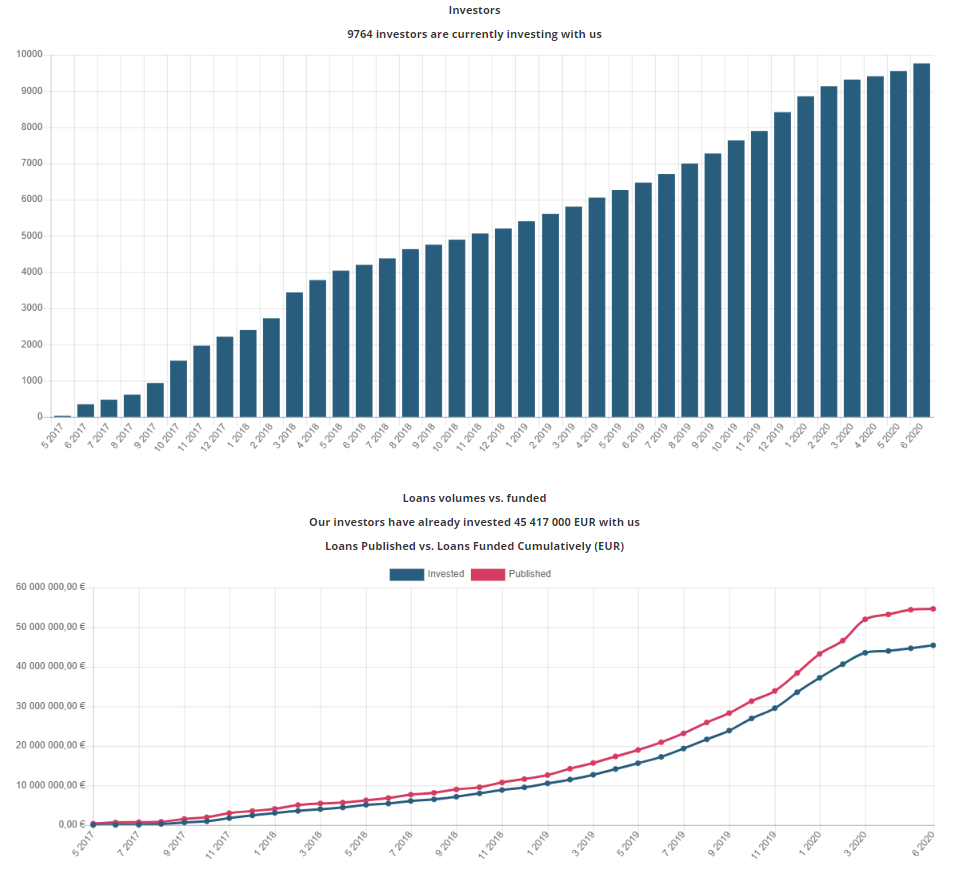

Currently, the amount of investors is skyrocketing.

Bondster currently has just under 10,000 people invested with them. However, over 50,000, 000 Euros has been published This means that the average amount of money that people invest is 5,000 Euros. This means you’ll be among some of the earliest investors if you choose to invest with Bondster.

Another great aspect of Bondster is that there are no hidden fees. They are extremely transparent every step of the way. Therefore, you can safely invest your money without ever having to worry about randomly being charged.

Conclusion

Peer 2 Peer Lending is an investment strategy where you invest money into loans in exchange for a profit over time. Bondster is a marketplace that offers multiple advantages. These advantages include a loyalty program, high returns, fast signup time, and a chance to invest with a company that is still relatively young. P2P lending is still a new concept to many people. Therefore, there is still a lot of progression and innovation that needs to be done within the industry. Due to this fact, there is still a lot of benefits that are still yet to be brought to investors within the industry. Add P2P lending without your portfolio to spike your returns and lower your risk.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.