Why Saving 10% Of Your Income Is Not Enough

If you grew up in a frugal family, chances are you’ve heard someone say “save 10% of your income” or rather “10% of every paycheck” at one point or another. However, what if I were to tell you that this is not nearly enough. That’s right, if you’re looking to retire, especially early, saving 10% is not enough. As a matter of fact, it’s not even close to enough. There are a lot of factors that need to be taken into account. These factors are the reason why saving 10% of your income won’t be enough in the long run. Therefore, let’s take a look at some of the reasons as to why need to be saving more.

Average Income

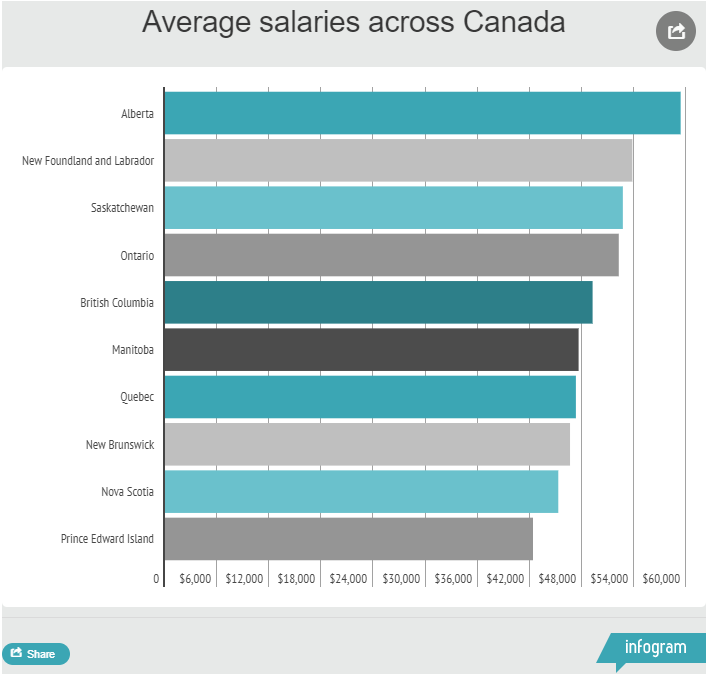

First, we need to look at the average income of a person living in an area. Ontario for example.

Above is a graph that outlines the average salaries across all territories in 2017. Since we’re looking at Ontario, the figure that we will work with $58,000. There are a lot of factors that can change this number such as a change in employment and salary raises. However, averages work best in these instances because everyone’s situation is unique to them. Therefore, we are offering a perspective.

For many of us, this is a large sum of money. However, can 10% of this amount per year last you through retirement? For the sake of this example, we will only use whole numbers.

Retirement Age

10% of 58,000 = $5,800. Not a bad amount you look at it objectively. However, how much would this be if we saved this amount until retirement? According to Stats Can, the average age of retirement is 63 years old and steadily increasing.

Back when I was younger (around 14 years old), my family always told me that I’d most likely retire when I was 60 -62 years old. I thought to myself that was quite old. However, I understood that I could speed that up if I desired. Needless to say, I was optimistic. What I wasn’t prepared for was the realization that if I didn’t find a way to become financially free, that 62-year retirement mark would shift greatly.

The point I’m trying to make is that since the cost of living is so expensive, jobs have less security, and the average retirement age is increasing. It’ll become increasingly harder to save and live off of 10% of your income once you’ve retired.

Let’s say that you acquired a job that pays $58,000 annually at the age of 25. Therefore, you save that $5,800 that we’ve previously mentioned, every year until 62 years old. $5,800 x 38 years = $214,600. Some people might think $214,600 is a lot of money. However, the sad truth is that it isn’t. At least, not anymore. However, to know why this amount isn’t enough, we’ll need to look at the average life expectancy.

Related Articles

- 9 Steps To Help You Retire Early & Wealthy

- What Would Happen If You Saved $30-$50 A Day?

- 7 More Passive Income Ideas

- 4 High-Return P2P Lending Platforms For Canadian Investors

Life Expectancy

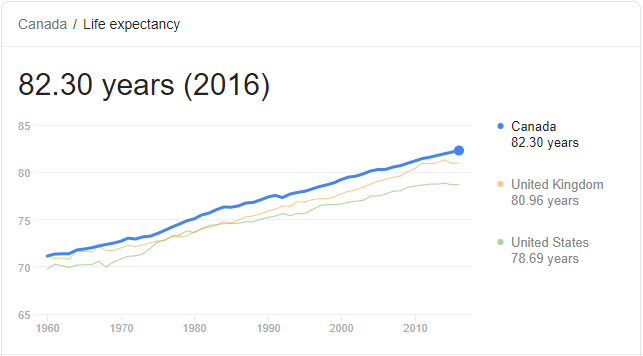

Life expectancy is exactly what it sounds like. How long you’re expected to live. The average Canadian can expect to live to 82 years old as of 2016.

This means that if you were to retire at 62 years old, like in the previous example, you can expect to live another 20 years. Do you know what that means? You’re expected to make that $200,00 last another 20 years.

If $214,600 still sounds like a lot of money to you, I promise you it won’t once we break it down. $214,600/20 years = $10,730 annually. Monthly this works out to $894 ($10,730/12 months). This means that in order to maintain your lifestyle after you retire at the age of 62, you’re monthly expenses have to equal less than $900 per month and that’s including inflation.

If you read my article How Important Is Long-Term Real Estate Investing, you’ll see that $900 isn’t enough to cover the average cost of rent in Ontario.

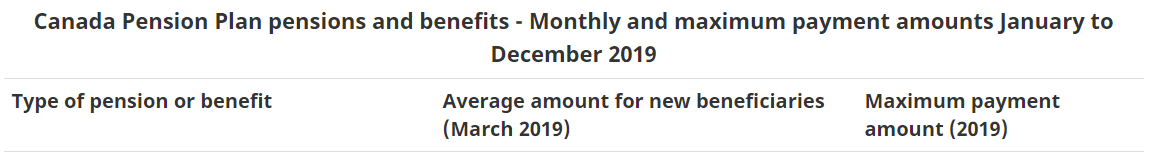

CPP

It’s important to remember that if you live in Canada, you pay towards your retirement pension plan. This can be claimed after the age of 65. There are many rules on how to go about claiming it. However, once you do, you’ll be able to obtain a certain amount of money every month. Below will be a graph on the average and maximum amounts you can earn. For more information on how CPP works, click here.

RRSP Contributions

Registered retirement savings plans are something that everyone should be familiar with. In short, it is a savings plan where you can contribute a percentage of your income towards your retirement. The benefit is that it is deposited before tax. When this is released back to you at the age of retirement, it is usually at a lesser take tax percentage.

This is something that everyone should have and use IN ADDITION to their monthly/annual savings or investments. It’s a great took to have that comes with many benefits. Furthermore, if the company has an option to match your RRSP contribution (up to a certain amount) you should take full advantage of this opportunity. Many companies do not have RRSP contributions anymore and even fewer are willing to match your amount.

Investments & HISA

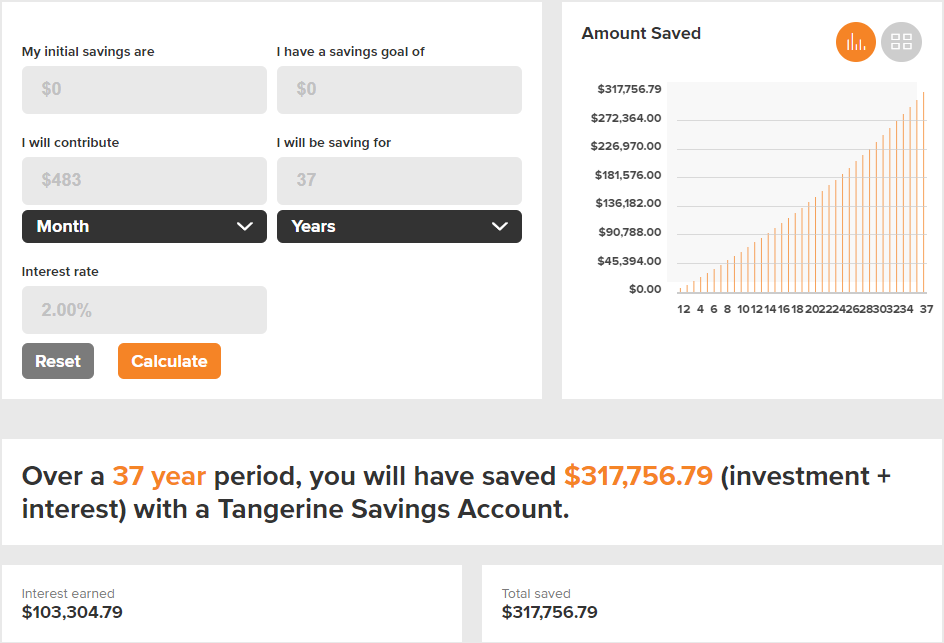

If you’re looking to retire and maintain a consistent lifestyle. It is vital that you look into high-interest savings accounts and long-term investing. These options can astronomically boost the amount you save over time. Let’s start with savings accounts. Open up a savings account that gives you 2% annually on your total amount.

Keeping the equation exactly the same with the exception of the 2% annual interest you will earn an additional $103,304.79! Therefore, all the money you’re saving should go directly into a high-interest savings account. Don’t believe me? See for yourself!

In terms of investments, we’re playing the long game. Find a portfolio strategy (low risk = low return) and stick with it. If you’re looking to for something that’ll grow with a low amount of risk, It’d be advantageous to invest in safer options such as bonds and ETFs. However, consulting a financial advisor would be the most optimal choice.

Once you’ve done this, if you’re able to earn an additional 3% – 5% growth on your portfolio annually, you will be earning even more than if you were to let your money sit in a savings account.

Early Retirement

Early retirement is like music to my ears, I’m sure many can relate. Most people would love to retire early. However, they usually lack the first step in retiring early and that is the numbers. By numbers, I not only mean how much you’ll need to earn per year but the amount they need to save per month.

For example, in order for me at 25 years, with $10,000 in savings, earning $50,000 a year to retire at the age of 52, I’ll need to save $2,719 per month or 65% of my income. However, this would only leave me with $2,450 per month for the rest of my life expectancy. If I want to retire and retain the same lifestyle, I’d need $1,800,000 to remain consistent.

Just looking at the numbers between retirement and early retirement can be quite jarring. However, once you become more financially literate, the numbers become less scary. This is because you’ll be able to devise a plan on how you can acquire your goals. The only thing that is left after you create your plan is doing it.

The numbers for everyone is different. Therefore, I implore you to take a look at the retirement calculator to find out what your retirement numbers are!

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.