What Are Futures And How Do They Work?

Investing comes in many forms. Some are long-term while others are short-term. However, all of them have their own advantages and disadvantages. For example, Options are a really good way to earn copious amounts of money in a relatively short time. Furthermore, there are a lot of methods to purchase options that are coupled with their own strategies. However, a disadvantage of options is that risk management is more complex and you can lose a considerable amount of money in a shorter amount of time. Furthermore, there are more fees than buying a typical stock. Lastly, the value of your option position can diminish as days go by. Therefore, you need to account for those factors as well.

One form of investing that I do not hear much about is futures. This may be for a few reasons. However, it seems like, in recent times, stocks and options have become much more popular. This is due to the recent boom we had at the beginning of the year where people made fortunes on a select few companies. However, there are other more popular investments that are rising to the top such as crypto. However, there are many people who still earn a considerable amount from the investment known as futures. Therefore, it is worth taking a look into what futures are and how they work.

What Are Futures?

Futures are financial contracts that value is dependent on an underlying asset or group of assets. These contracts obligate those who own it to transact an asset at a predetermined date and price. These underlying assets can be for physical commodities. However, they may also come in other forms. For example, there are a few types of futures. Examples of these futures contracts are index, commodity, currency, stock, and interest rate futures. For the sake of the article, we will take a look at commodity futures to give an example of what underlying assets can be accessed.

In terms of commodity futures, there are a few typical assets that are well known. These assets are crude oil, silver, gold, gas, corn, and wheat. In terms of the names of the contracts, futures are named after the month they end in. I.e. January contracts, February contracts, etc. However, similar to stocks, futures can have quite a considerable amount of volatility. Therefore, you will have the potential to earn a lot of money. However, there is also the possibility that you can lose a considerable amount of money as well.

There are many strategies when it comes to purchasing futures. However, one popular strategy that companies and businesses practice is hedging. Hedging is the practice of preventing potential losses through investing. An example of this is when you purchase the stock but it seems to be going down. You can then place a short position and gain money from it going down, effectively mitigating your initial loss.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- From Hello To Hired: Breaking Through The Interview

How Do They Work?

Futures have a lot of detail within them and how they work. However, an easier way to portray how futures work is through an example.

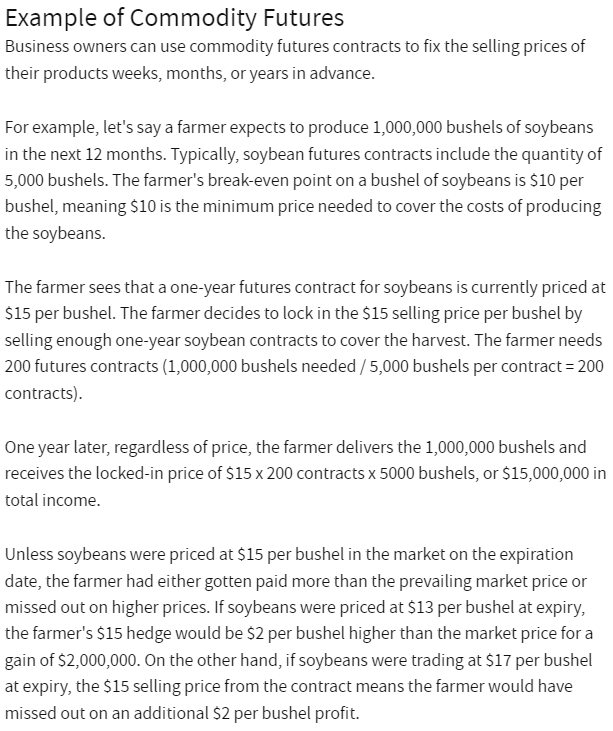

Above is an example of commodity futures. In the example above, a farmer is expected to produce a certain amount of soybeans within the next year. However, each futures contract is for a maximum of 5,000 bushels and the break-even amount is $10 per bushel. After this, the farmer decides to lock in a $15 selling price per bushel. This means that regardless of the price in a year’s time, the farmer will sell the number of contracts he has for $15 per bushel. In the instance provided above, this means that the farmer needs to purchase and sell 200 contracts.

The example then goes on to state that depending on the market price at the time to contract expires, the farmer will either earn more than the prevailing market price or lose out on potential profits.

Let’s say that at the end of the year, the contract expires and soybean bushels are now selling at $13 each. This means that the farmer would have earned an extra $2 per bushel because his contracts sell at $15 each, regardless of what the current price is. However, Let’s say that the current price at the time of expiry is now $17 per bushel. This means that the farmer now missed out on $2 per bushel. To put this in perspective, using the formula from the example, this amount can either be a $2,000,000 profit or “loss” for the farmer.

Therefore, futures can be an excellent way to earn money. However, it is completely possible to either lose or miss out on potential earnings.

How Do You Purchase A Future?

If you’ve ever traded stocks or cryptocurrency, you will see that buying and selling futures is quite similar. There are many different ways that you can purchase futures. However, one of the most popular ways is through interactive brokers. The reason why interactive brokers are so popular is that they have a wide variety of products, they have relatively good service and low commissions. For anyone starting out, low commissions are something to look out for. This is due to the fact that commissions tend to eat away at your profits. Therefore, the lower the commissions you pay, the more money you’ll have at the end of the day.

After you’ve found your method of purchasing futures, you will need to provide the necessary documentation to open your account. Once your account is open, you will need to fund your account with the necessary funds., The amount of money you fund your account with depends on your goals and budget. Some people have higher budgets than others. Now that your account is funded, the next step is to purchase your futures contracts. However, before you do any sort of investing, it is important to develop discipline and a strategy. Once you’ve done this, you will see that investing becomes easier and more profitable in the long run. Although, seeing results will most likely take a much longer time than initially anticipated.

How Much Money Can You Earn?

In terms of how much money you can earn, it is hard to quantify. This is due to the fact that futures and its market are volatile. Furthermore, you are likely to earn more money with the more risk and funds you have. However, the risk does not always come with a reward. Therefore, it is highly likely that you will lose your capital. Let’s use the example from above. While the amount may be out of reach for some, we can scale it down to an amount that is more common. Instead of 200 contracts, let’s say you purchase 10 contracts. However, each contract is 10 bushels at $15 each. In this example, the total income would be $1,500. Now, let’s say that the contract at the end of the year is $13 per bushel. You’ve effectively earned $200 or $2 per bushel more. This number can be scaled to a shorter period of time. However, many of the contracts are different with various stipulations.

However, if you set a goal for how much money you want to earn. With enough preparation and strategy, it will most likely be attainable.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.