Tech Companies You May Want To Invest In

This article includes links for which we may receive compensation if you click. However, at no cost to you.

When it comes to investing, there are many options. For example, you can invest in other businesses, real estate, and stocks. However, arguably one of the most common forms of investing is through the stock market. Even if you don’t entirely know what the stock market is or how it works, chances are you’ve heard of it. Therefore, it goes without saying that a lot of money can be made within the stock market. However, there are many different sectors within the stock market that one can choose to invest in. For example, a relatively popular sector with increasing amounts of volatility is Marijuana. You’ll find stocks such as $ACD (Aurora Cannabis) increasing and decreasing as much as 10% per week.

Similar to the weed industry, the tech sector can be very volatile and provide a lot of room to grow. There have been many tech stocks that blew up and made people millions of dollars. The difference between the average investor and a more seasoned professional is knowing when to invest. Furthermore, seasoned investors spend most of their time searching for stocks and reading. They know what to look for and when to execute the trades. Therefore, in this article, we will outline a few stocks that are on an upwards trend. Furthermore, they will be within the tech sector.

Palantir

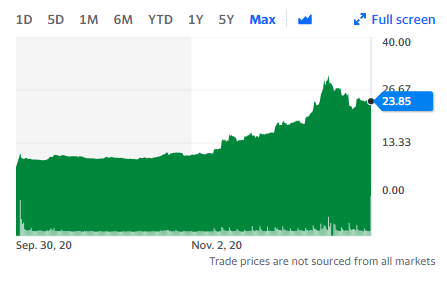

One tech stock that has been extremely popular right now is Palantir Technologies ($PLTR). This may be your first time hearing about this stock. However, anyone who is into stock trading, particularly in the tech sector has most likely come across this stock at one time or another. One of the main features about this stock which has got so much attention is that its price has increased significantly since its September 30th release. To put this into context, the stock opened at around $7 per share. However, quite recently, it reached its all-time high of over $32. This happened at the end of November. This means that the stock’s price soared nearly x5 in a matter of three months.

As you can see from the picture above, $PLTR has had quite the growth in the past few months. However, some people say that this was too fast and not sustainable. There have been a few analysts and hedge fund personnel who’ve come out and voiced their worries/opinions on $PLTR which have caused a halt in the momentum of the stock. For example, Citron or Andrew Left took to Twitter and said that Palantir is “no longer a stock but a full casino”. From this, he explained that he’ll be shorting the stock. Next is Morgan Stanley who claims that purchasing this stock now means that you’ll be buying it at a “significant premium”. In a nutshell, these people are saying that the price went up so much that the stock is now overvalued.

.While this may or may not be true, there are some underlying facts that can’t be ignored. First is that the company is continually growing and retail buyers are consistently beating out institutions with short positions. While the stock may go down, there is a lot of support to the point where the stock bounces back. Next is the fact that Palantir believes its total addressable market is around 6,000 companies with over $500,000,000 in revenue. Based on their estimates, Palantir hasn’t scratched the surface of their potential market. As of right now, they have less than 1% of their potential market. This means that there is a lot of room for growth. Furthermore, Palantir’s year over year revenue has been increasing. This is all while maintaining a relatively low amount of debt.

An extremely informative article can be found here. This article is a must-read if you’re looking to invest in this company. Furthermore, if you’re already invested within the company, you will still want to read this article. It provides some critical insight on what’s going on with Palantir and its growth path.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- From Hello To Hired: Breaking Through The Interview

- How To Start Your Very Own Blog

- How To Market And Monetize Your Blog

Zillow

Next on our list of the tech stocks that you may want to invest in is Zillow ($ZG). Zillow, which was made public last year. While Zillow has been around for a long time, I personally only heard about them this year. However, Zillow provides a lot of value to both shareholders and users. For those of you who don’t know, Zillow is a company that specializes in real estate. More specifically, they’re a real estate database that allows users to find, buy, sell, and/or rent homes.

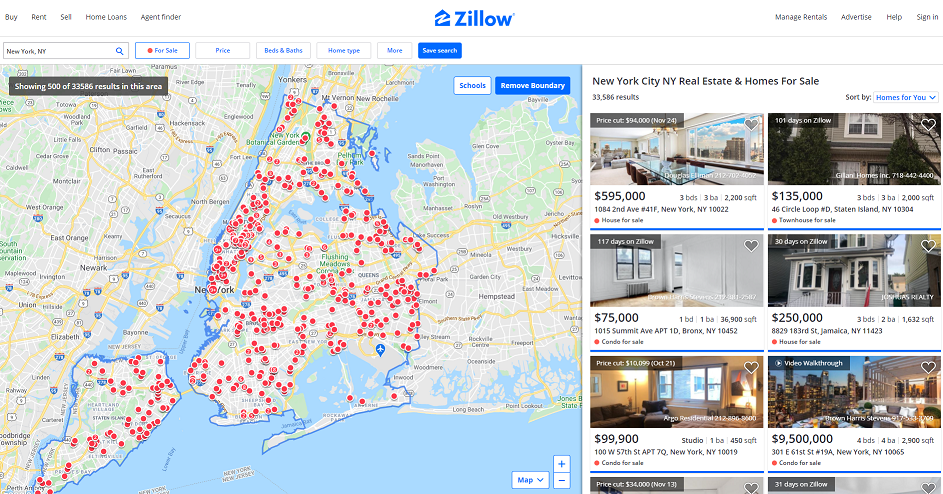

Essentially, Zillow makes house hunting, buying, and renting stress-free. If you’ve ever bought or sold your home, you’ll know how stressful this can be. However, all you need to do is type in your state, city, address, etc. After that, you choose whether you want to buy or rent a house. From there, you can change filters and choose homes according to your search results.

Above is a picture of what you might find if you do a vague search for real estate in New York City. Each dot represents a property for sale while on the right gives a bigger picture.

While Zillow has made money primarily through advertisement, they are branching off into more promising streams of income. For example, Zillow has a property management tool and is even looking to create a brokerage. Soon enough, Zillow may even expand into providing loans for those looking to buy a house. Furthermore, Zillow offers users the option to sell their property to them for a cash offer. This creates a more stress-free and seamless process. The goal of Zillow is to make the home buying experience seamless from start to finish without having to use anything else but their product.

As you can see, Zillow has been growing exponentially this year. There was a dip at the end of March (most likely due to COVID). However, since then Zillow has gone from $23 per share to over $100. What makes this company a potentially worthwhile investment is its rapid growth. First, Zillow’s revenue increases year over year. Next, as of the end of September, Zillow’s current asset to liability ratio is over 10. Moreover, Zillow can pay off their entire liability with their assets and still have a substantial amount of money. Although they have not been profitable yet, they’re expanding at a rapid pace in terms of popularity, infrastructure, and revenue growth.

Slack

Last on our list of tech companies you may want to invest in is Slack ($WORK). Slack, much like Zillow, is a company that’s been around for a bit of time but I have only heard of them this year. Many companies use Slack and there is a high chance that maybe you, the reader, have used Slack. Essentially, Slack is a business communication software that allows people within a business to communicate with each other. Think of it as Discord, WhatsApp, or Facebook Messenger for business. You’re able to separate teams, set events, alerts, share photos, and much more.

Slack is great for a few reasons. The first is that it has the potential to scale to whatever size your business is. Whether you employ 5 or 500 people, Slack can be used by anyone within the business. Considering the fact that since COVID happened, working from home is becoming more popular. Furthermore, digital workplaces are becoming more common as businesses are being run through the internet constantly. If your company is small you can get away with using apps like Discord. However, as the company grows, you’ll need to use a program that specializes in organization for business to business interactions.

Much like Zillow, Slack is reporting steady revenue growth quarter after quarter. An example of this is the fact that Slack earned $181,000 in revenue in Q1. However, in the final quarter, they’re reporting over $200,000, making their total amount almost over the $1,000,000 mark.

Much like the previous companies we’ve talked about, Slack has been on an upward trend, even reaching its high. While this is the case, the company has a lot of room to grow due to sheer scalability and the fact that the software is versatile. Their balance sheet looks great with assets higher than their liabilities. Therefore, this is definitely a stock you will want to take a look into.

One Final Thought

If you’re looking for a trading platform with zero commissions, try out Wealthsimple. I recently started using it over TD Direct Investing and it has saved me a lot of money in commission fees. I’ll most likely make an article on it in the future but I just wanted to add this section as it is relevant and has helped me out tremendously. Click this link and you’ll receive $10 for free after you deposit your first $100.

Thank you for all your support.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.