How To Go On The Vacation Of Your Dreams

When you retire, what are some of the things you plan on doing? I bet one of them is traveling. However, have you thought of going on your dream vacation early? Most people have, me being one of them. However, many people have trouble saving for a vacation. It takes a lot more than setting aside money in order to save up for your dream vacation. You have to choose the destination, set a date and utilize every resource you have. People really underestimate the advantages of creating a plan. A plan is crucial in all forms of saving, especially for trips. However, there are times where you’ll tray away from the plan. When this happens, it’s best to get yourself back on track.

Choose The Vacation Destination

Choosing a destination is the first step. However, we’re talking about your dream destination. Therefore, you should already have a place in mind. If not, there are many websites that can show you great places for you to vacation to. For example, USA Today has an article on luxury vacations that are cheaper than most people assumed.

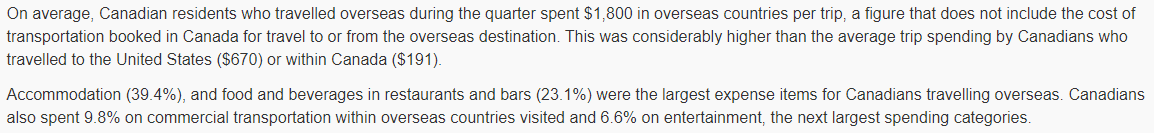

If you’re looking into cost, you need to know your budget. Canadians spend a lot of money on travel. This includes the ticket, activities, food, shelter and maybe even travel insurance. Here is a quote by the Government of Canada explaining the average amount of Canadians spent on a trip overseas.

The two highest charges being accommodations and eating out at restaurants/bars. Therefore, looking at the amount that the average Canadian spends ($1,800), you can base your budget around this as the number. Although, there are a lot of factors that play into how much you’ll actually spend. However, it’s always good to start at the average/high number because if you don’t spend it all or get a good deal, you’ll have a little extra side cash for your trip.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- What Is Credit Card Churning?

- Highest Paying Trade Jobs In Canada

- High-Interest Savings Accounts That You Should Have

Set A Date

Next is setting the date. However, I don’t mean any random date. The date should be realistic and calculated. Take a holistic view of your life as it is. Take a look at your expenses, position at work, and responsibilities, Is taking a vacation right for you at this moment? If yes, when is it the right moment? 1 or maybe 2 years from now? Furthermore, are you earning enough to go on a vacation?

I’ve seen many people break their bank and take time away from their job which puts them behind. Although you can do this, I wouldn’t recommend it. This is due to the fact that you could be put extremely far behind. However, this is why we said your vacation needs to be calculated.

The goal is for you to pick a date in the future that’ll allow you to go on a vacation that won’t affect your current life or savings. Base this time off of your income and how much you’re able to save per paycheck. This does a few things. First, it allows you to get excited. Nothing feels better than building up anticipation and inching closer to the vacation of your dreams. This feeling is similar to when you go to university/college. 13 years are spent within the schooling system with the hopes of eventually reaching that higher level of education. It’s the pay off that many people wait for.

Second, you’re developing a skill. The skill of creating a goal and steadily working towards it. Creating small goals that’ll help you achieve a bigger goal is something that people tend to not understand. The bigger picture is made up of smaller pictures.

Start Saving

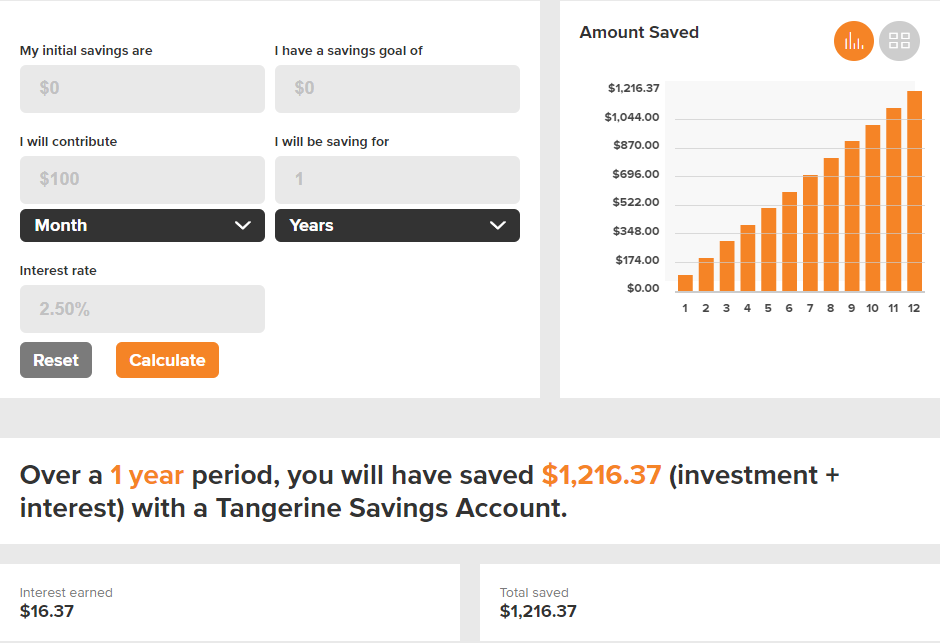

Now, you start saving. The amount you save should be based on how much you make and the date you set. Therefore, if your vacation is a year away and costs $1,200, you’ll want to save $100 per month. Granted, saving this much doesn’t affect you negatively. If $100 a month is too much, aim for $50 and extend your date for another year. Only you will know the proper amount to save.

There are many things you can do to save. Cutting down on costs is a great way to save more money in order to speed up that trip you’re planning. Furthermore, any money you save needs to be in a high-interest savings account. However, you can also deposit your money in long-term investments that are easily liquidated. For example, using an app called Mylo, you can make one-time deposits, invest your spare change on everyday purchases and liquidate all your funds within 2-5 business days.

Apps like this will help you save on vacations and grow your money so you can reach your goal faster or have extra money for your travels. If apps aren’t for you, getting a high-interest savings account will work just fine.

If you put your money into a high-interest savings account, not only will you be able to get your money whenever you want but you’ll also earn interest. For example, the picture above shows that if you were to save only $100 a month in a 2.5% interest savings account, you’d earn $16 for just having your money in there. Although this may not seem like much, it’s $16 that you didn’t have before that can be used towards the trip. Furthermore, the more you deposit and the longer you have the money marinating, the more you’ll earn.

Travel Rewards

One benefit that people grossly overlook is the idea of earning travel points. When you do this, you can eventually cash them in for travel rewards! How do you get these travel rewards? Well, all you have to do is purchase everyday items. However, you do need a credit card. Every major bank has a credit card that allows you to get travel rewards. There are also special bonuses such as purchasing groceries that get you 2x the travel rewards.

The next step is to just spend money as usual. However, there are ways of accumulating points faster. One way is to put your bills on your credit card. This revolving bill will help you get travel rewards points every month. Every bank determines a set value of these points. For example, 15,000 points can be $150. This means that each point is worth $0.01. Others may say that 15,000 points are $450. Meaning each point is worth $0.03. Some people get credit cards based solely on these values. Therefore, if you’re planning to take a trip in the future, get a rewards card and start using it on your purchases.

Lastly is to look for cards that have travel reward signup bonuses! These are bonuses that the credit card company gives you when a credit card is opened on your account. For example, RBC gives 15,000 points which are equal to a $450 one way ticket. The bonuses are often given after three billing cycles. However, saving for a whole year and stacking rewards points will ensure that you will either have to save less money or have more to spend on your trip.

Credit Card Churning

Without going too much into it, credit card churning is the act of constantly opening up credit cards to get the signup bonus! For example, opening up a credit card, using it for a few months, getting the bonus, closing it, then reopening the card. However, you could also keep the card. It’s important to note that keeping the cards can be overwhelming.

For more information on credit card churning, visit our dedicated article here.

Find Cheaper Flights

The last step is finding cheaper flights. This can be done in a bunch of different ways. If you’re planning on using your points to book a plane ticket, this would most likely be the cheapest way. This is due to the fact that much of the cost is mitigated by the points that you’ll be using. However, what is some ways to find cheaper flights without using points?

One way is choosing the right day to fly. Some days are cheaper than others. One way of identifying a cheap day is to simply compare them. See how much your ticket will be if you fly out on a Tuesday instead of a Friday. You can also use a website called Skyscanner which allows you to identify the cheapest month.

Second, clearing your cookies and searching for flights incognito may help as well. This will mask your previous search result which will stop travel sights from increasing prices. They do this in order to scare the user into thinking that the prices are going up and that they might miss out on a good deal.

The next option you have is to find budget airlines and book connecting flights. Since flights that are connecting take multiple stops, they tend to be cheaper. The last point that I want to discuss is that you should always mix and match.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.