What Would Happen If You Saved $30 – $50 A Day?

As I was growing up, my mother always told me that I should be saving my money. She never told me the purpose, only that it’s good to save because I may need it in the future. This was very basic but solid advice. However, she never told me how much to save. There are many different strategies you can find on the internet, some more difficult than others. What I’m going to share with you is probably the simplest strategy that you could ever have. It does not require a financial planner or for you to allocate your earnings in a complex manner. However, this one strategy alone won’t make you retire early, It’s what you do with the money that’ll help you reach that goal of early retirement!

1. Let’s Define Early Retirement

Back in the day, retirement meant that you’d work until you were 65. At that point, you’re officially done working and will retrieve your old age pension or the income stream from your RRIF! Now, the dynamic of retiring early has slightly changed. Retirement is more so correlated to financial stability. This means, if you are financially stable enough to not have to work a day in your life, you can retire early! Furthermore, early retirement can be at any age.

If you’ve made millions of dollars and have extremely lucrative investments but are only 32 years old, you can retire. However, retiring does not mean that you are ineligible to work. You are still able to work if you want. As a matter of fact, many people I know who have retired still work because it provides a certain degree of fulfillment.

2. How Much Money Would I Need?

Well, there is no right amount of money. The fact of the matter is that it depends solely on your spending habits. Theoretically, you’ll want to save a large amount of money that’ll last you well into the future. The amount you save needs to be relative to what you spend. This means that if you’re spending $30,000 a year on general/necessary expenses, you’ll want to save 20 – 40x that amount. With this amount saved up, you can withdraw a small portion of that money every year to keep up with your current lifestyle. However, this is just a ballpark number, you should always account for how much you will possibly spend in the future!

These calculations do not include any investments that are able to offer you a steady source of income. These numbers should be used as a beginners guide to saving money for early retirement! Therefore, note down all of your annual expenses. This will allow you to see how much money you may need to save and progress to the next steps.

3. What Would Happen If You Saved $30 – $50 A Day?

More than you ever thought was possible. However, before we get into what’ll happen I’d like to address how difficult it may be to actually start saving. For me, it was extremely hard. I would always think there was a better use for that $50 than just sitting in an account. Some would say that I was thinking very short-term. Those people were right. Many people don’t understand the concept of growth and just love to spend. However, the goal here isn’t to just “save” the $30 – $50 a day, but to also invest it!

Since we’re looking at the long term, you’ll want to put whatever money you save into an investment account that is earning money through a low risk, low reward method. A method that increases your invested money by at least 4% – 5% annually! There are many different investments that are able to do this. However, we will get into that a bit later. I’d like to show you with a simple savings calculator how this may play out.

Examples

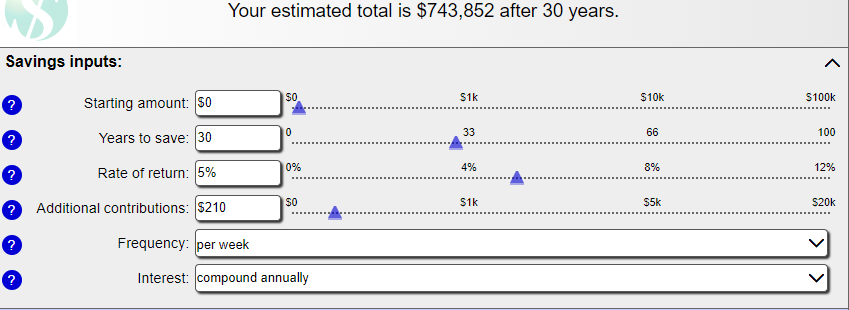

First, let’s take a look at if you were to save $30 a day. To some, this may not be a lot but for some people but that perspective varies. We’ll say that your account is at zero and that you’re starting now. With a savings plan that’ll last you 30 years, gaining 5% interest annually, your funds will look like this:

As you can see, if you were to save only $30 a day for 30 years, you’d accumulate $743,852. That’s nearly one million dollars for just depositing a fraction of what a typical full-time employee is making per day! However, how much would you accumulate if you were to save $50 a day? Let’s check:

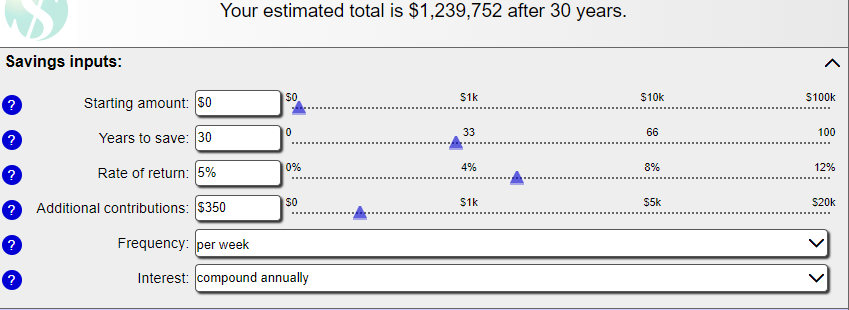

As you can see, saving that extra $20 will bring your total up to $1,239.752! That is an incredible amount! If I were to apply this calculation to myself. This means my saving strategy would end by the time I hit 55 years old. Furthermore, I’d be able to take out over $41,000 per year for the next 30 years after I turn 55! However, I tend to live frugally which means $41,000 will probably be more than enough for me to sustain my lifestyle!

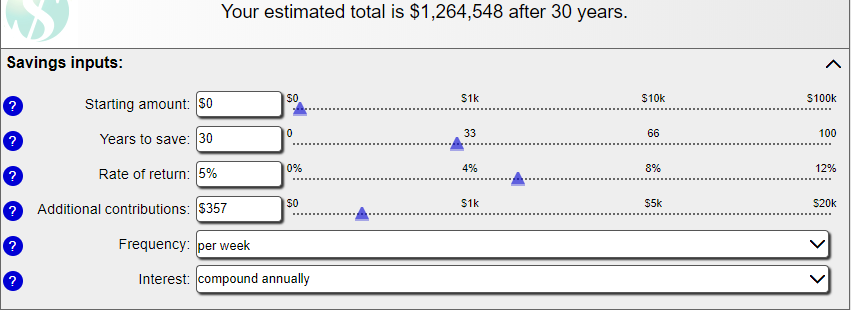

Although, I understand that individual situations vary. That’s why I want to make it clear that the point is that you should start saving/investing now, even if the amount would be small. Trust me, every single dollar counts. Oh, you don’t believe me? Well, let me show you the difference between saving $50 a day and $51:

What you’re seeing is correct. The difference between investing $51 as opposed to $50 is the sum of $24,769. Can you believe that? If you were to invest $1 more every single day, you’ll accumulate over $20,000. Therefore, I strongly suggest that you start saving now! Remember, the more you save, the better. Say you recently fell into a bit of money through your promotion or tax return. Invest it. Received a bonus? Invest it, earning money from a side hustle? invest it. The more money you’re investing on a daily basis, the earlier you’ll be able to retire. Due to the 5% annual interest, the more money saved/invested = the more you’ll earn and the earlier you’ll be able to retire!

4. Well, What Should I Invest In?

There are a number of different avenues that you can take. Some methods have higher returns than others but have the disadvantage of being riskier. Since we’re in it for the long haul, we’ll be discussing methods that focus on long-term growth as appose to short-term gain!

RRSP

A Registered Retirement Savings Plan is a good way to start saving your money. It can be provided through your work or bank. This strategy allows you to deposit money from your paycheck, directly into the account before any tax has been taken out. This can be seen as forced savings because you’ll be unable to take that money out before you retire without heavy taxation. The money is typically released at the age of 65 in the form of an income stream.

The purpose of this is for those who retire to still have money being deposited into their account on a regular basis. In other words, this is the money they’ll be living off of until they die. The maximum amount that one can contribute is 18% of the previous year’s salary and can be used as a tool to reduce one’s taxable income. Depending on your income, that 18% can put you into a lower tax bracket, effectively allowing you to save on taxes! Although this is a good way to save money and everyone should be using it, it does not necessarily help your money grow.

Stocks

The most common form of investing. Even those who don’t invest possess at least some knowledge on stocks. In case you’re new to the world of finance, stocks or shares are ownership of a company that you can purchase. The reason why these are such good investments, especially in the long-term is that they increase in value over time. If a company is doing well and people believe in it, they are going to want a piece of the pie. The constant demand for a stock will cause the price to go up.

Let’s say you had $1,000 and bought 100 shares of a company at $10 per stock. You earn $1 for every $0.01 that the stock increases in value. The stock market has made many people wealthy and many people poor. However, if you research the various ways to evaluate a stock and make your investments based off of due diligence, the only thing that’ll stop you is bad luck. Investing in the stock market is one of the most common ways that someone can make money in their sleep.

But Wait, There’s More!

There are many different ways that you could invest in the stock market. Of course, there is the most common method where someone buys a stock and waits for it to go up, this is what we call a “long position”. However, there are two other methods that should at least be mentioned. The second method is called taking a short position or shorting a stock. This method involves finding a stock that you may believe is overvalued or about to drop in price. Once you’ve found the stock, you can sell the stock first and then buy it back at a lower price (hopefully).

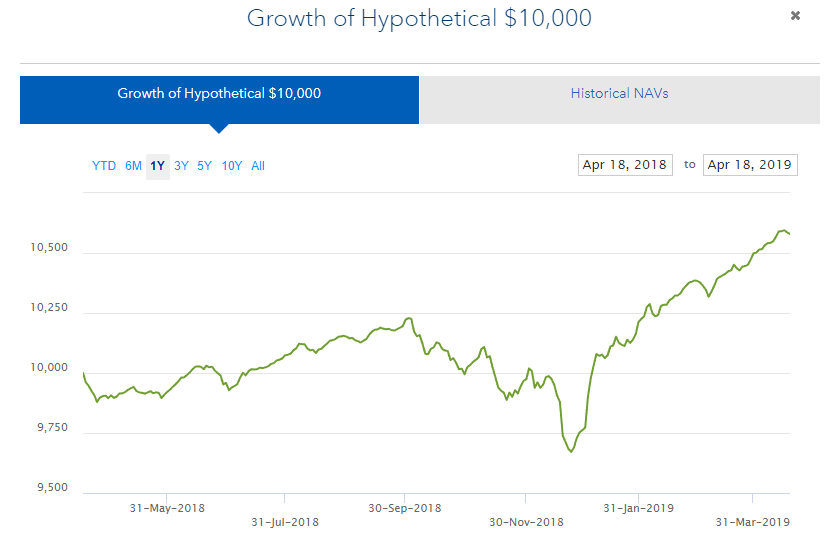

Lastly, you may invest in ETFs or mutual funds. These two methods operate in a similar manner because they are both funds that are traded on the stock exchange. However, ETFs tend to be cheaper and the prices fluctuate on a regular basis, similar to stocks. Mutual funds and ETFs have management fees or transaction costs. However, these two investment strategies offer diversification which allows you to mitigate risk and earn money over time. Furthermore, you’ll be able to invest in a multitude of stocks without constantly paying for transaction fees and commissions. Due to the fact that many of us are visual learners, here is a hypothetical growth chart for an ETF called HYG

As you can see, through this particular ETF, your $10,000 investment would have grown to just over $10,500. A quick calculation lets us know that this increase is over 5%. Of course, there are times when the ETF is fluctuating. However, there is a very clear upward trend. If you want to take a deeper look and see how much that $10,000 would’ve increased in al longer period of time, I’ll provide the link here.

Bonds

Bonds are a great way to earn money over time with a very little amount of risk. This is an avenue that should be apart of anyone’s portfolio because of its likelihood to make you money. Bonds or fixed income investments are debts that can be bought for a certain amount, often decided by the demand. That’s right, you’re loaning out your money to companies who need it. However, due to it’s less risky nature, bonds are less lucrative than stocks.

The way you get paid out is through interest either annually or semi-annually. This means that if you have a bond that matures in one year and has a 10% interest rate. A $1000 bond will pay you $50 semi-annually or $100 when it matures. However, you may not want to rush into buying a bunch of bonds because they have their own set of fees when you purchase them individually. This means you’ll most likely want to purchase them through ETFs or Mutual Funds. This way you’ll be able to acquire the diversification you’re looking for without constantly paying transaction fees. This is especially true when it comes to stocks.

Real Estate

Real estate has remained one of the lucrative ways to invest. There are many different ways that you can earn money through real estate. The thing that makes real estate so attractive is that if you choose to invest through owning a property, the value will most likely increase. However, we’ll quickly talk about various ways that real estate can be incorporated into your portfolio.

Buy & Rent/House Hacking

Although becoming a landlord can be a bit of a headache, the pros outweigh the cons in most cases. The objective is to buy a house and hope the value perpetually increases. Not only that but you’re paying into the mortgage, sounds like a win-win right? However, there is a way to make real estate investing more efficient.

A couple of my friends each rent out a room in a house and the basement is also being rented out. However, the landlord also resides in the house. What he is doing is called house hacking. The landlord is using his house to generate 3 rental incomes from one property. What’s even more impressive is that since there are three people, he is gaining an excessive amount of money that is being treated as an income stream. Therefore, his house is appreciating, the mortgage is being paid off and he has an income stream. Do you see how powerful real estate can be? There are people who’ve gained early retirement status from just investing in real estate!

Here is a nearly 10-year glance at the increase in real estate value within Ontario, Canada:

If you’re not a fan of having a physical house but still like the idea of investing in real estate, REITs might be for you. REITs (real estate investment trusts) are funds that you can invest into that allow your money to be diversified through different real estate investments. The goal is to make your money. increase in value. You may be thinking “This sounds like an ETF” and you wouldn’t be wrong for thinking that. ETFs and REITs share a lot of similarities!

5. A Few Parting Words

Here are a few tips that’ll help you when you’re looking to invest and increase your portfolio. Of course, you will need to do copious amounts of research before you make your initial investments. However, there are a few rules of thumb that you should definitely follow!

Only Invest In What You Know

This is common and probably the most important rule to follow. You should only invest in industries or companies that you fully understand. Investing in a company that you’re knowledgable about will make your life 10x easier. Understand what a company does, where its money is being spent and the major moves that it’s trying to make. By doing this you’ll be able to combat potential losses and anticipate the wins! Although it is fully plausible to learn about an entirely new industry and begin investing. However, due diligence and a complete grasp on the industry is needed before you invest.

I’ve seen many advertisements on Youtube about opening up your very own Shopify dropshipping store. They claim that you’ll make tons of money with very little investment. I’ve personally met many people who’ve gone into this industry without knowing the first thing about it because the concept was simple. However, even if the concept is simple, the execution may be complex. Yes, you can advertise a product and sell it for a small profit. However, it takes industry knowledge to know how to stay competitive with that particular item. Furthermore, you need to know about marketing and branding. This is why you must research and truly decide if you’re ready to understand or have enough knowledge to be successful in a particular investment.

Allocation Is The Name Of The Game

Don’t forget that you need to grow your money over time with the least amount of risk. Having multiple investments that can hedge potential losses is critical in a healthy investment portfolio. Have a good amount of money in a multitude of stocks that you’re able to see long-term growth in. This can be individual stocks or through mutual funds/ETFs. Bonds are essential because of their less risky nature and tendency to payback without the worry of defaulting. Therefore, a good chunk of your portfolio should include bonds as well. Real estate can be a bit tricky because you may need capital to start. However, when you decide to begin investing in real estate, it should be at least 10% of your portfolio. As you learn and grow, it would be advantageous to up that percentage considerably.

Remember, The Sooner, The Better

That’ll conclude this relatively long post. Just remember that you don’t need tons of money to get started. You can start saving/investing right now with a small amount of money. As you saw above, even one dollar can make a colossal difference. Therefore, start saving now with whatever you can. As you become more experienced or are able to invest more, do it. It’ll only help you out in the future. The goal is to retire early or maybe you just want to retire comfortably. Regardless of what your goal is, investing is crucial to financial stability and early retirement. Learn about investing/saving, decreasing fees and taxes as much as you can. I know you can do it, all you need to do is start!

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.