Should The Retirement Age Increase?

After working for decades, you’ll eventually reach the age in which you will want to retire. This is exciting for some. However, many people find themselves discontent. This can be for many reasons. Some people simply like to work, others hate the idea of getting old. Lastly, there is an increasing fear that the retirement age may be too low. Since technology and humans are evolving, this doesn’t seem like a bad idea. Of course, this means you’ll have to work longer. However, the benefit might just be what Canadians need. Therefore, we’re going to look at the current retirement age, retirement age over the years and whether or not it should increase.

Current Retirement Age

When you start your first job, you’ll have taxes to pay. One of these taxes goes towards your pension that you’ll acquire after you retire. However, the age that this becomes available is 65. Although, you are able to obtain it earlier. However, this will most likely affect the amount you receive on a monthly bases.

That being said the average age of retirement is 65 years old. This is the time that people stop working and claim their benefits. These benefits can be your RRSP, CPP, and other social security programs/investments. One thing people may not know is that there is a maximum amount of money you can receive during your retirement.

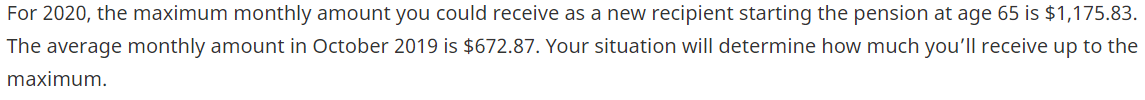

Take a look at the amount of money you can receive from CPP. Is $1,175.83 enough for you to live off of? Maybe. However, for many people, they won’t be able to. Considering the fact that bills don’t decrease in amount as you get older, most people will be earning much less once they hit retirement. The crazy part is that the average CPP monthly amount is $672.

For some, this is also a lot of money. However, according to the Canadian government, the average income in 2018 was $48,000 (both sexes, 16 years and older). A quick calculation will tell you that this equates to approximately $4,000 a month. Therefore, those who are earning this amount of money will be in losing a huge amount of money once they go into retirement.

The key is to do a number of things to make sure that you’re able to sustain your current lifestyle once you retire. These factors include saving, investing, and creating something of your own. Of course, the latter is optional. Some people have jobs that give great retirement packages and pay a high enough wage that the savings can last you the rest of your life. However, before we get into the importance of all these factors, let’s take a look at the retirement age over the years.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Why Saving 10% of Your Income Is Not Enough

- Highest Paying Trade Jobs In Canada

- What Would Happen If You Saved $30 – $50 A Day?

- High-Interest Savings Accounts That You Should Have

Retirement Age Over The Years

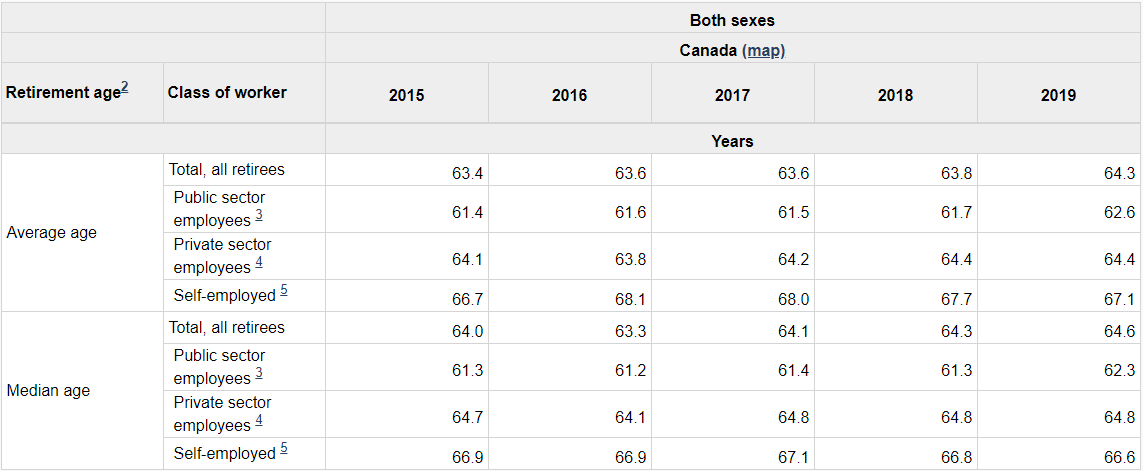

The retirement age over the years has been increasing. Slowly but surely. Here is a chart that shows the average retirement age across 4 years.

Looking at either the median or average age for retirement, they’re both around the same. Rounding up, these numbers equal 65 years old. As the years go on, people tend to find more satisfaction in their job. Others don’t want to stop working. This can contribute to the increasing age of retirement. However, the retirement age has barely moved all this time. It seems that 65 years old is a good age for people to retire.

At this point in life, you’re by no means “young”. However, you still have a lot to look forward to. Travel, hobbies and even side ventures. For example, Colonel Sanders founded KFC in his later years. There is no age where opportunity expires. Therefore, the way the economy is progressing, there is only an incremental change over the years. However, should the retirement age increase? There is a lot of speculation about whether or not it should be increased. However, we must look at both sides of the argument.

Should The Retirement Age Increase?

Should the retirement age increase? Well, the answer isn’t a yes or no. It honestly depends on many factors. First, what are the problems with the current retirement age of 65? It’s been the gold standard for years. An age I’ve been told about since I was a kid. Therefore, can there really be any problems with it? In short, yes. Technology, society, and medicine are evolving rapidly. Therefore, it’s only natural that life expectancy will increase as well. At first glance, this may not seem like a problem. However, with the increase in life expectancy, you can expect that people will run out of savings.

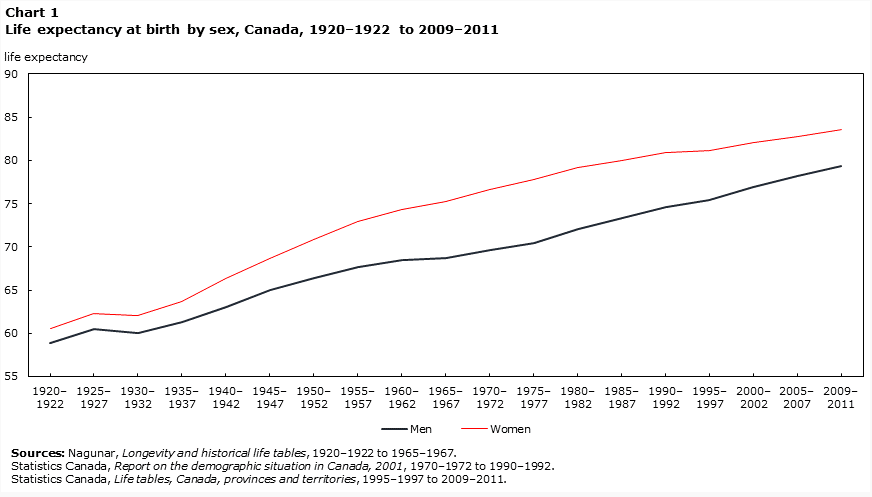

Above is a chart that shows the average life expectancy of men and women for almost a decade. As you can see, the average life expectancy has been steadily increasing. However, there was a sudden dip around 1930 and then an increase sparked. This was most likely aided by the invention of penicillin in 1928 by Alexander Fleming.

Up until 2011, the retirement age is around 77 – 85. It’s reasonable to believe that since then, age has increased further. Therefore, the likelihood of an individual outliving their savings becomes more realistic. Even if you pay off your mortgage and are debt-free, living on a fixed income is not easy. There are still other bills to take into account. Furthermore, a fixed income leaves less room for spending.

Let’s take $100,000. A large sum of money for most. However, if that was the amount of savings you had after you retire at 65 years old, how much would you be living off of for 20 years? $416/m. Add that in with your CPP and you have just over $1,000 per month. This is supposed to take care of living expenses, insurances, debt, and your retirement plan (travel, etc). Furthermore, we have to take inflation into account. The cost of living is always increasing. Therefore, that $100,000 may not be able to last you as long as it would have 20 years ago.

When you look at it from this perspective, it probably is a good idea to increase the retirement age. Living a longer life means its only natural to work longer. That way, you have a higher amount of income coming in and the length of retirement is shortened. This ensures the longevity of your savings and ensures that you will be able to keep up with your current lifestyle. However, some people working in hard labor jobs may not like this notion. This is due to the fact that they work in highly stressful jobs. They may want a break or their body might not be able to keep up with the workload anymore.

Although increasing the retirement age may not be the absolute solution to any problems old age security has, it can definitely help.

How To Not Run Out Of Money During Your Retirement Age

There are many decisions that you can make not to make sure your retirement is comfortable. First, open up an RRSP, preferably one that matches contributions and deposit as much as you can into it. Next, start saving more than you already are. The more money you put into a high-interest savings account, the more interest you’ll earn over time. When saving for retirement, time is your friend and enemy.

Earn more money. Simply put, if you earn more money, you can contribute more to your RRSP and savings. This will increase the momentum of your savings and gives you a much larger cushion.

Next is to invest. Invest in an asset that will bring you revenue for as long as possible. Purchasing properties and renting them out is a good way to build credit and solid revenue streams. People are always going to need shelter. Therefore, even if you’re 90 years old, you’ll always have that various amounts of rental income. Even if you’re not a real estate person, stocks, ETFs and bonds may be the way to go.

Creating a low-risk portfolio now with long-term growth potential can accumulate quite the capital. Investing in a blue-chip stock that pays out quarterly dividends that are reinvested might also be the way to go. Of course, you wouldn’t invest all your money and you’ll have to do research. However, you could always get a financial advisor who’ll create a holistic portfolio that’ll ensure the sustainability and long-term growth of your money.

Lastly, decreasing your lifestyle if a good way to ensure your money lasts. Chances are your kids will be moved out and it’ll be you with your significant other. Therefore, there is no need for a large house with all the bells and whistles. However, regardless of what you choose to do, looking into a plan for your retirement now is always a great idea. Whether you’re 16 or 30, anytime is a good time.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.