What Is Mylo & Why You Need It

It’s been a while since I wrote a blog on investing. Therefore, this gives me the opportunity to talk about an app that I find to be absolutely amazing. This app is called Mylo and it’s meant for those who would like to begin investing but don’t know where to start. Mylo makes investing and saving seamless. It takes out a lot of the leg work you need to start effectively investing. In my opinion, this app is a great way to start investing and I’ll tell you why.

What Is Mylo?

Mylo (click any of the highlighted Mylo links and receive a free $5!) is an app that helps the average Canadian invest their money efficiently. Before you start thinking this is just another Questrade or online broker, there are many differences.

Many of these online brokerages require you to deposit money and leave you to invest on your own. However, a lot can give you solid advice on where to put your money. Mylo does everything for you. They round up your everyday purchases to the nearest dollar and invest that change into a diversified portfolio. This is where Mylo really stands out, in my opinion.

They found a way for Canadians to invest their money while making it convenient, cost-effective and mitigating risk. Furthermore, the app helps you gain wealth over time without you having to think about it. You can just go about your daily life, check the app after a month and see that you’ve saved hundreds of dollars. Don’t forget, this money you saved is also growing, double the benefits! So, let’s get into how this app works!

How Does It Work?

First, you have to download the app and create an account. This can take up to 10-20 minutes because you have to go through various steps. Since it’s an app focused on saving and investing, they need you to put in your goals. Once this is done you’re able to put how much money you’d like to save, how much you earn, your risk profile and the time limit.

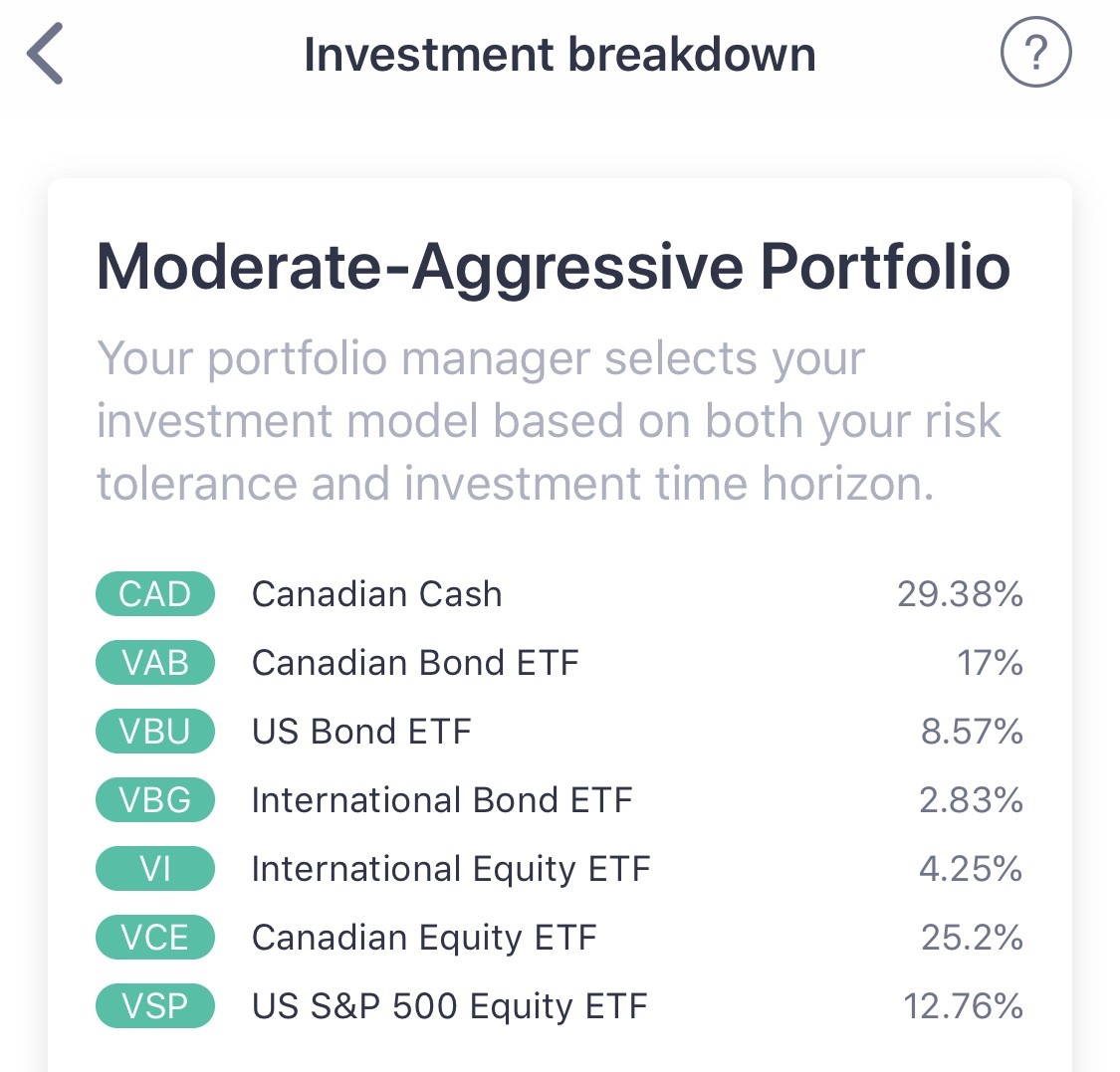

From there, connect the bank account you’d like the money to come out of and the cards you’d like Mylo to round the purchases up from. Once this is all done, you have to wait for 5 – 10 business days. This reason for this is because a portfolio manager looks over your goals and income. They create a plan that’ll maximize your profits while abiding by your risk tolerance.

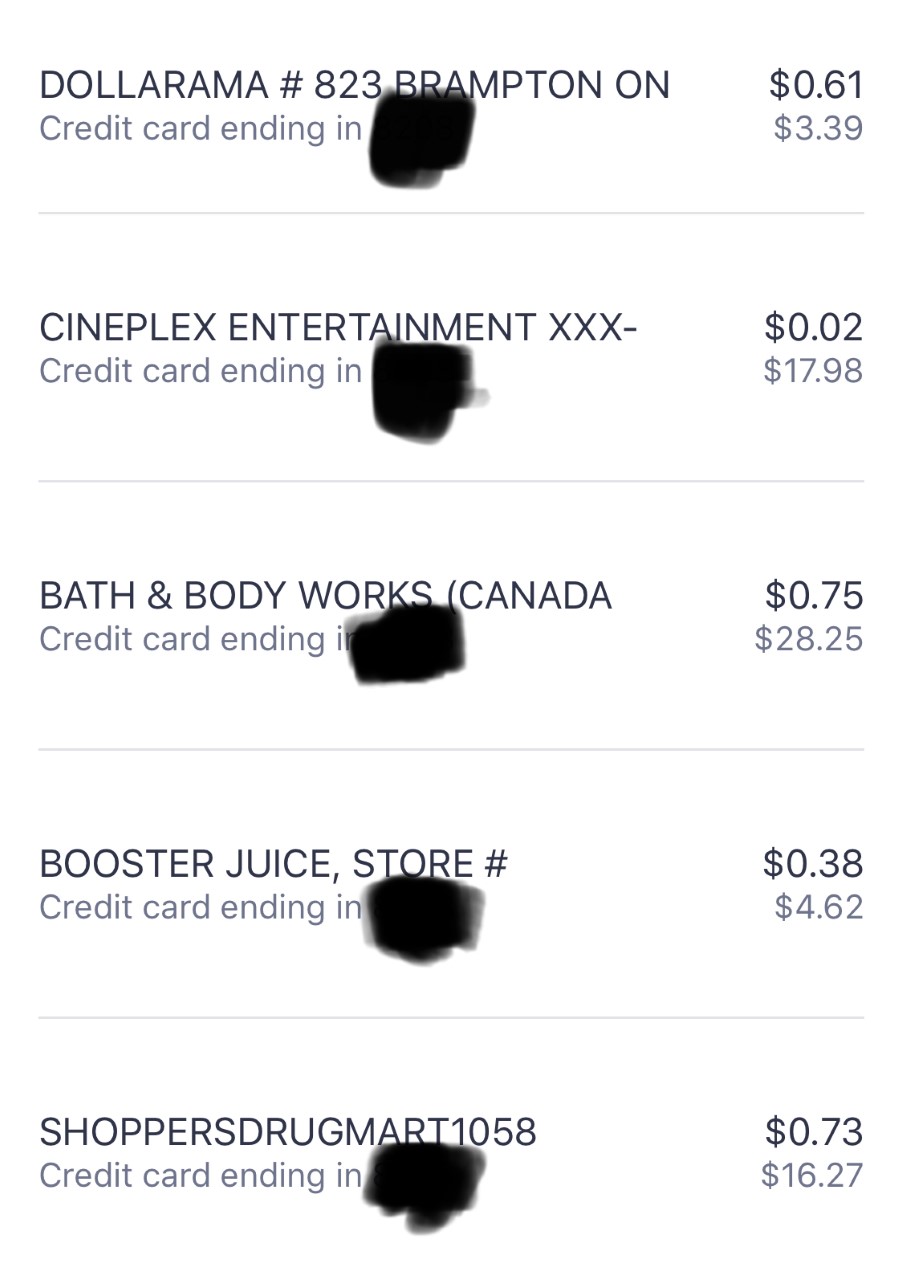

Now that you’re account is created, it’s time to start investing. As I said, Mylo rounds up your everyday purchases. For example, you went to Tim Hortons and bought a coffee for $2.25 Mylo will take that 75 cents and add it to a “roundup”. Mylo will continue to add these up and on every Monday (excluding holidays), they’ll deposit the sum of all round-ups! I’ll put pictures below as a visual aid.

Above are a few of the purchases that Mylo is rounding up. For this week, the app rounded up $14.76 and that money will be deposited into a diversified portfolio on Monday. What I truly enjoy about this app is that they utilize a multitude of ETFs in order to maximize gains and minimize losses. They even have the ability to invest your money into both Canadian and US ETFs, as well as various bonds. Here is a quick glance at what my personalized portfolio looks like!

This app is a powerful tool. There are so many functions and perks that I could not possibly explain them all in on blog post. However, some key features are that you can save for more than one goal at a time. Say you have two goals and just bought a coffee for $2.25. Mylo will put 75 cents in each investment, making your round up total $1.50. Furthermore. you can make your roundups more aggressive by adding $1 on top of your roundup amount.

It is important to note that the app costs $1 a month for a regular account and $3 for Mylo advantage. However, Mylo advantage offers many perks that can offset this cost. For example, currently, if you purchase anything from the Gap clothing store, Mylo will rebate you $3 directly into your investment account! You even get a free $5 when signing up through any of the highlighted Mylo Links! Sound’s amazing right?

Seriously, there is so much to talk about but if I tell you everything, you won’t be surprised when you use the app. Now that we got the basics, out of the way, should you use Mylo?

Related Articles

- 5 Ways To Invest $100

- 7 Passive Income Ideas

- 4 High-Return P2P Lending Platforms For Canadian Investors

- What Would Happen If You Saved $30 – $50 A Day?

Should You Use It?

The answer is, yes! I honestly think that everyone should get this app. It allows you to invest, grow your wealth and save all at the same time. Signing up takes very little effort, the app has an easy to use interface and provides a ton of value. Furthermore, you don’t have to worry about your money being unavailable. You can withdraw your funds within a few days!

This is an app that I personally use and believe provides it’s used with tremendous value. As I said, there are many perks that were not mentioned but I’m sure once you’ve downloaded and traversed the app, you’ll become a pro!

That’s all I have to say about the app for now. Don’t forget the checkout Mylo’s Official Website for any other questions you may have!. I’ll leave the rest of the discovering, saving and investing up to you!

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.