What Do Canadians Spend Their Money On?

An unfortunate (or fortunate, depending on your perspective) aspect of our society is that nothing is free. Therefore, unless you’re a child or live a very privileged life, you will have an amalgamation of costs and bills. Some are recreational. However, many are mandatory. This can be for housing, food, and even insurances, to name a few. Some of you reading this may be able to relate as you may have bills similar to what we will discuss. Furthermore, you may be spending the same amount. However, that is the point of this particular article, to outline the spending habits of Canadians.

While some may think that doing this is senseless, it will do a few things that will deem advantageous. First, it’ll show the allocation of spending for the average Canadian. With that information, you’ll be able to reflect on your spending and budgeting habits. Now that you have the knowledge, you’ve gained power, so to speak. Knowledge is power and if you know your spending habits, you can change them. This means allocate your money more wisely and save in areas. Most wealthy people will say that one of the keys to becoming financially free is knowing where your money is going. Therefore, the goal is to take a look at the average Canadian’s spending and see if we can do something to benefit us in our own lives.

What Sectors Have The Most Spending?

Where you are, province-wise will often reflect how much you spend on certain aspects. An example of this is shelter or housing. Housing in some areas is significantly cheaper than in other areas. For example, purchasing a house in Guelph will be significantly cheaper than one within Toronto. With that being said, where is the most money spent allocated?

First is housing or shelter. If we’re looking at a per house statistic from 2019. Roughly 30% of the household’s income goes towards living expenses. This means that if your household earns approximately $100,000 per year, $30,000 will go towards housing. While this is a large portion, it is something that is necessary. Furthermore, it is usually relative to the person’s income. Therefore, if you’re earning $50,000 per year, your housing expenses will typically fall around $15,000 per year. To get a more accurate reading let’s take a look at the government of Canada. They estimate 29.3% of spending over $68,980 is due to housing. To put it simply, $20,211.14 is dedicated solely to housing.

The next one is transportation. Some may have thought that food would be the second allocation. However, that is a close third. In terms of transportation, the percentage allocation would be 18.5%. This is due to many factors. Car payments, insurance, gas, bus, train, and other forms of transportation. To give you a visual relative to the number given above ($68,980), transportation would cost $12,761.30.

The third and most highly allocated section is food, as previously mentioned. This shouldn’t be a surprise to anyone as it is absolutely essential. While you can mitigate your spending on food by purchasing cheaper products and eating out less, it is still a vital aspect of anyone’s budget.

The last section that occupies more than 10% of spending is household operations. This includes but is not limited to furnishing, maintenance, and renovations. You can add this to the housing costs. However, it belongs in its own section due to the fact that these are separate expenses from renting fees and mortgages.

The remaining spending is spread out through various groups. This includes recreational spending, tobacco, clothing, education, health, and personal care.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- From Hello To Hired: Breaking Through The Interview

- Why You Should Open A Wealthsimple Account

- How To Start Your Very Own Blog

- How To Market And Monetize Your Blog

Spending Over The Years

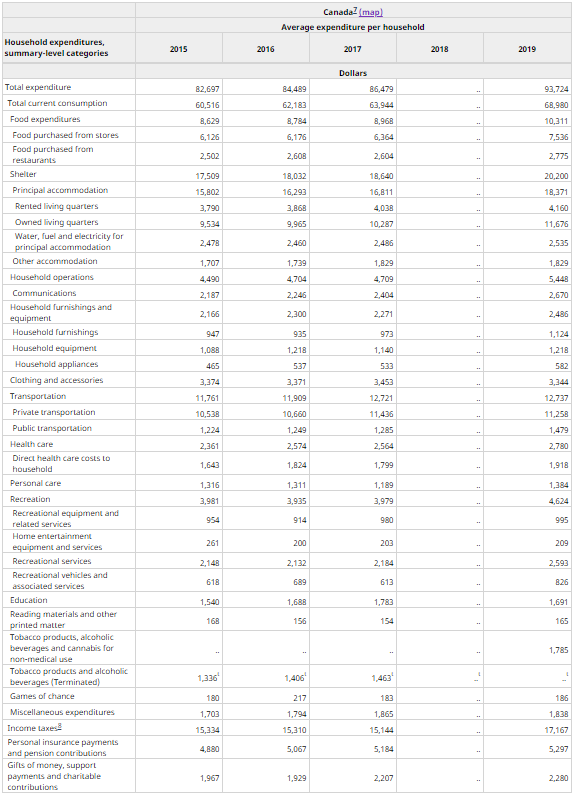

It’s no surprise that due to factors such as inflation, that Canadians are spending more money over the years. However, how much more money are they spending? Luckily for us, this information is readily available. If we take a look at the government of Canada website, we can take a look at household spending through the years, up until 2019. For this article, we’ll take a look at 2015 – 2019. Without taking a deep dive into it, the average household expenditure in 2015 was over $80,000. However, as of 2019, the average spending per household increased to over $90,000 annually.

If you take a look at the picture above, you’ll see the growth between the years (excluding 2018). However, through the years, you can see a clear increase in the three main sectors we’ve talked about. This is housing, food, and transportation. However, not every expense has gone up. If you take a look at the chart, you’ll see a column named household equipment. This increase went now and as of 2019, returned to the same levels that were present in 2016. Therefore, the key expenses have increased. This means that while everything didn’t increase, the surrounding expenses increase by a considerable amount causing a holistic change.

If you’d like to have a better look at the chart, you can click the image and it’ll take you to the website. There, you’ll get a larger image.

What To Do Next

There are many things that you can do with this information. The information is as valuable as you make it. To some, this information will probably mean nothing. However, others can take this information and use it in a way that may be advantageous to them. For example, if you look at the allocation percentages, that can lead you to wonder about your own expenditure. From doing this, you can develop a habit that is critical for anyone looking to improve their financial situation. That is tracking your finances. Like I said previously, if you track your finances, you will have the power to make serious changes in your financial situation.

Let’s say that you take a look at your finances and realize that you’ve been spending too much money on food. You can adjust this spending and maybe even create a budget around it. This small change can potentially save you hundreds or even thousands of dollars per year. Housing would also be a great example of how you can save money. I know many people who spend well over 30% of their annual/monthly income on housing. If this is the case, there are a few paths you can take to decrease this amount. This first is moving to somewhere that is more affordable. Of course, this isn’t the easiest option in the world. The other is finding roommates. That way, you can split the rent between a multitude of people.

If all else fails, you can try and negotiate your rent. This can be a great way to decrease your rent and save you money. There is a multitude of ways to go about this. However, negotiating your rent can have benefits for both you and the owner. First, if you can negotiate and guarantee that you’ll sign your lease for another year, that takes stress off the landlord. They won’t have to find a new tenant and risk their property becoming vacant for an undefined amount of time. Therefore, check the listings and housings/rent costs of the properties around you. You may find that there is room to negotiate.

With all that being said, looking at this information, the main takeaways should be that everyone has mandatory expenses. However, reflect on your own financial situation and see if there is room for improvement.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.