The Top 9 Best Assets That You Can Own

In order to become truly wealthy, you have to invest. Investing can provide long-term income that is unmatched. However, knowing exactly what to invest in can be quite a challenge. Investing involves risk. Therefore, people make it their mission to find the best and most lucrative assets they can. However, the type of asset that you choose is dependent on your investing style.

For example, many people who like high risk and reward will go for assets that are a bit more volatile. However, those who like a safer route will choose assets that will mitigate any risk and provide a more assured return. To make it easier, we will clarify what we mean by an asset. An asset is something that you own that can either increase in value or bring in any sort of income/profit. However, not that we clarified the definition we’ll be working in, let’s begin (in no particular order).

Bonds

The first on our list is a bond. If you don’t know what that is, a bond can be seen as a loan. However, this is not a loan that you’ll be taking out. Rather, it is money that you will be giving to an investor who will pay it back within a set period of time with interest. The best way to think of this is to imagine that you’re a bank. An investor comes to you, get money, and pays you back in increments over time.

This is one of the best assets you can have because of its overwhelming advantages. First, it’s a low-risk investment as there is a low likelihood of you losing your money. However, just the risk is low doesn’t mean that you have a zero chance of losing your money. There is always a chance that investors can default. This can lead to late payments or a loss of money.

Above are a few more benefits to owning a bond, including that it is one of the safest investments available in Canada. One important factor to note is that bonds are correlated to interest rates. However, their relationship is inverse. This means that when interest rates increase, the prices of bonds go down and vice versa.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- Real Estate: Buying Vs Renting

- High-Interest Savings Accounts That You Should Have

- Earning Money During The Coronavirus

- Should You Buy A New Or Used Car?

Real Estate Investment Trusts

Real estate investment trusts or REITs are an interesting investment. It takes the idea of dividends, stocks, or mutual funds and applies it to real estate. This investment is also great because it is relatively safe. So what are REITs? Well, a REIT is a company that either owns, operates or finances properties that produce income. A good example of this is a company that owns a multitude of rental homes that generate income. However, you as the investor get a return that is coming out of the company’s taxable income. This return is also returned to the investors in a dividend-like return. Where you invest money and you receive money, quarterly, semi-annually, or any other option that is available.

One of the reasons that this is such a good investment is because of its stability. Properties are known to greatly appreciate over time. Therefore, the companies income and your dividend return will increase in the long-term. If you ever wanted to invest in a REIT speak to a financial advisor or broker. As they are listed on major stock exchanges.

Dividends

Dividends are an amazing investment and are the top choice or a lot of famous entrepreneurs. Moguls like Warren Buffet and Kevin O’Leary both advocate for stocks that pay dividends. Why is this? Well, many of the companies that pay out dividends are blue-chip stocks. These are companies with national reputations that are known to succeed through tough financial times. Some examples of blue-chip stocks are major banks and telecommunication companies like Bell. Why buy a stock that pays dividends? Because you’re essentially earning money for just having shares in the company. This can be seen as a passive income that is being generated from an investment. Below is a video on why Kevin O’Leary only purchases stocks that pay dividends.

Here is an example of how dividend stocks could benefit you and your portfolio. Let’s say you purchase 100 stocks from Bell at $40 each. Bell’s average dividend payout is $0.55 per share and payout quarterly. This means you will receive $55 quarterly just for owning Bell shares. This money can either go into your investing account or be reinvested to purchase more stocks. The latter is usually recommended because its a way to increase your yield and make your money work for you.

Property

Next, we have property. Property is one of the most lucrative assets that you can have. Many people have made their fortune from real estate investing. However, we put “property” as an umbrella term because there are so many ways to make money. For example, you can purchase a vacation home and rent it out through Airbnb. Although everything is stagnant at the moment, once the pandemic is gone, people are going to travel whenever they can. Flipping houses is another good way to leverage your asset (property) to earn extra income.

Purchasing a home that is undervalued, fixing key problems, and reselling it for a nice margin. Lastly, you can rent out a property. This is the goal for many up and coming real estate investors. Purchasing an undervalued house and fixing it up will earn you money through the sheer appreciation. However, you can rent out this house to garner a steady income. This will not only slowly pay off the house, building equity but you’ll earn an income stream and further appreciation on your property.

Create Your Own Business/Product

The next asset that we’ll talk about is creating your own business or product. This is probably the option that I would say is the most rewarding. However, it can also be extremely difficult. Creating your own business can be anything, car detailing, fixing a computer, or even creating an eBook. Developing and skill and monetizing it is one of the keys to having financial freedom. Of course, it’ll take a lot of hard work because you’ll have so much to manage and learn. However, let’s say you create an eBook. That book may have taken you a year to create. However, once it’s ready to be published, all you have to do is market. After that, you’ll receive monetary compensation.

With your own business, you can scale and eventually quit your day job, focusing all your time and effort onto it. In my opinion, this is the greatest asset you can earn. It offers the opportunity for financial and time freedom. Furthermore, you gain discipline and priceless knowledge that can be applied throughout your life/career.

Peer-to-Peer Lending

Peer-to-peer lending a quite new in Canada. However, it is starting to gain traction as it is becoming more popular. What is p2p lending? To put it simply, p2p lending is similar to bonds in a few ways. Companies will go onto websites such as Lending Loop and request a loan for X number of dollars, let’s say $20,000. You can then give money towards this loan. After this, the money will get paid back to you in increments over the course of a few years (2-5). However, this payment will include interest. The interest is stated before you place the loan. However, it can vary based on a few factors such as how big the loan is and its risk factor. There is a much higher chance that you the company will default in p2p lending compared to bonds.

High-Interest Savings Account

If there is an asset that everyone should have regardless of age, its a high-interest savings accounts. High-interest savings account have no limit, usually no fee and zero age restrictions. Therefore, once you open a bank account (if you don’t already have one), you should create a HISA as well. Another reason as to why you should have a HISA is that there are no negative consequences or risks. The money you put in there is a liquid investment which means that you can take it out at any time. Furthermore, you’re accumulating interest and earning money for doing basically nothing. Of course, this should not be the only investment in your portfolio. However, it should definitely be in it as it provides a return on an extremely low-risk investment.

A Car

Although a car is a depreciating asset and can cost you more money than they’re worth, it can be quite advantageous. However, in order for it to be an asset worth having, you need to consider the following. Cars save you time. If you’re taking the bus to work and it’s a 2-hour commute, a car can cut that down by 70%. Time is valuable and we have a limited amount of it. Therefore, saving time to do other stuff such as catch up on sleeping or doing something you love can be well worth it.

Cars can be used for so much more than driving to work. You can use them to deliver food or participate in ride-sharing apps all on your day off. Let’s say you have a car but barely use it. There is a website called Turo that lets you lend/rent your car out to other people who need it for a certain amount of time. At that point, your car will literally be making you money while you stay at home or are at work.

GIC

Last on our list is a GIC or Guaranteed Investment Certificate. This is often one of the first investments that people get, along with a high-interest savings account. This is due to the face that the investment has a guaranteed return. Thus nullifying any risk of losing your investment. However, the tradeoff is that the money you make in return is a lot less than most other investments.

It is definitely still worth it if you’re just starting off and have some spare cash lying around. The investment will be given back to you over a fixed period of time. However, the amount of money you receive is dependent on a few factors such as current interest rates and the length of the GIC’s term.

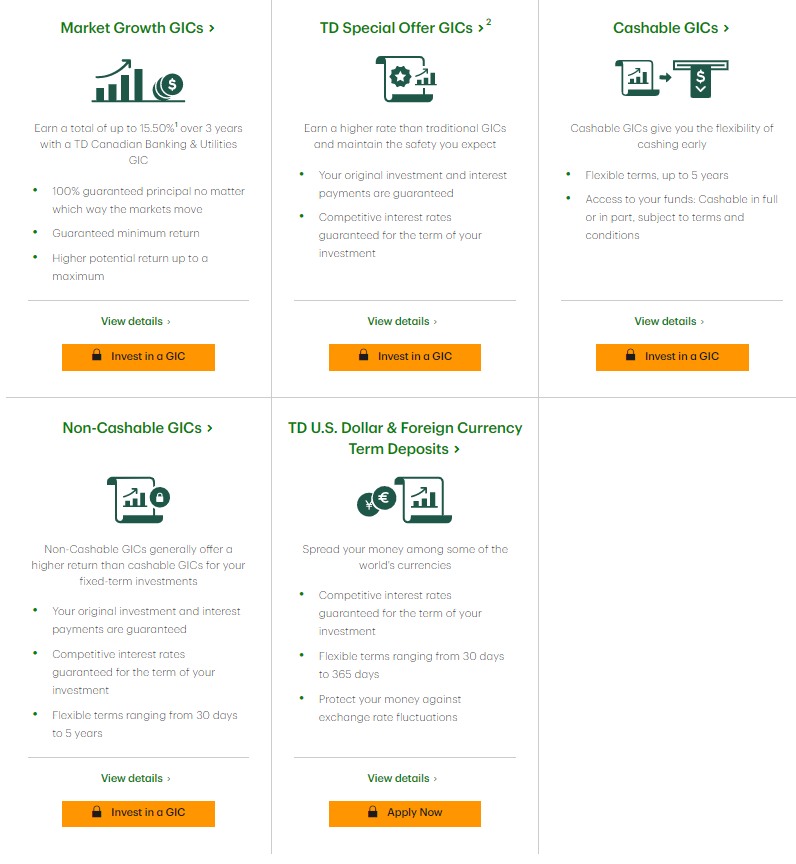

Here is a picture (click the link to go to the website) of some of the GICs that TD bank offers. There is also an outline of their various benefits and how they compare to the other GICs.

What I want most people to take away from this is that although all of these investments are great, they work best in conjunction with each other. Your portfolio should be diversified. Filled with low, medium, and sometimes high-risk investments. This offers variety and a higher likelihood that you’ll build your wealth at a rapid pace.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.