What Is Shorting A Stock And Why Its Useful

Stocks, ETFs, and other forms of investments are a hot topic right now. Even with the stock market going crazy because of all the news surrounding GameStop and AMC. However, by the time you read this article, the hype may have died down. Although this may be true, many people are starting to get into investing, even if it’s a small amount. Regardless of the amount, you should only invest if you know what you’re doing. This means understanding what stocks are, how the market works, and the company that you’re investing into. There are many aspects of a company and its stocks. We’ve covered many different aspects on our website. However, one feature of buying and selling stocks that we haven’t talked about yet is shorting.

Shorting a stock can be a great way to earn money through the market. However, it’s not a conventional way of trading shares. Of course, many people can do it, even you. However, it carries a different amount of risk compared to the traditional way of purchasing stocks. Therefore, doing your due diligence and having the necessary amount of capital is absolutely critical. Moving on from the intro, we will discuss what shorting a stock is, how to do it, and the pros/cons.

What Is Shorting A Stock?

Purchasing a stock a quite simple in its nature. Everyone knows the basic rules of investing. Buy low and sell high. Of course, this is ideal and won’t happen every time. This is due to the fact that you can never know which way the market or stock will move 100% of the time. There are ways that you can predict a trend and have a high likelihood of earning money from an increase. This is how scalpers and day traders earn money. There are specific tells in a stocks chart that’ll indicate whether it’ll go up or down within a certain amount of time. Of course, this isn’t a perfect science. However, there are proven strategies that are known to work.

Now some people might be asking, what is shorting a stock? It, in a nutshell, is the complete opposite of how you would traditionally purchase a stock. When shorting a stock, instead of buying first and selling later, it’s the complete opposite. You sell the shares first, then buy them back at a later date. This may sound confusing and unconventional. However, allow me to elaborate further to remove any confusion.

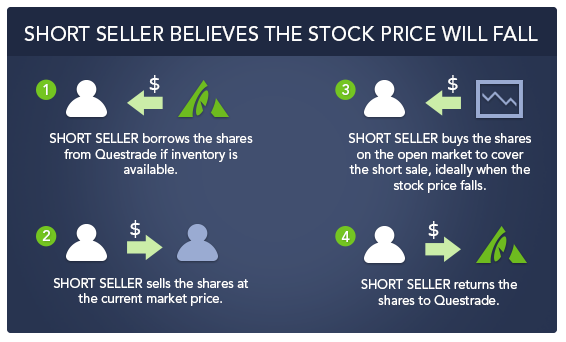

When you short a stock, you need to do it through a brokerage in a margin account. For this example, we’ll use Questrade. First, you borrow the shares from Questrade. Then you sell it on the open market for a set price. After a certain amount of time, you will need to buy back the shares, hopefully at a lower price than what you initially sold them for. Once the shares are bought back, you return them back to Questrade.

To further exemplify this strategy, we’ll use numbers. Let’s say you start off at $0. Once you’ve sold the shares on the market after receiving them from Questrade, your account will be credited. For example, you sell 100 shares of a stock priced at $100. This means you’ll now have $10,000 in your account. Now, it’s time to buy back the stock the next day. However, the share price went down to $50 per share. This means you’re buying back the 100 shares for a total of $5,000. Once you’ve returned the shares back to Questrade, you will have an excess of $5,000 in your account. Above is a picture provided by Questrade, giving a visual representation.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- From Hello To Hired: Breaking Through The Interview

- Why You Should Open A Wealthsimple Account

- How To Start Your Very Own Blog!

- Marketing And Monetizing Your Blog

How Do You Short A Stock?

Onto the topic of how to short a stock. We briefly touched on it above. However, we will reiterate. You will need to open a margin account. Margin accounts may have requirements to open. However, the requirements may vary depending on the brokerage. For example, opening a margin account with thinkorswim requires a deposit of $25,000 USD. Therefore, you will meet any requirements. After that, certain brokers have rules you will need to follow when shorting a stock. Therefore, make sure you’re privy to those conditions.

Some brokers allow you to participate in short positions online, while others may not. However, a generally accepted method would be to call the broker’s trade desk. This is true for both Questrade and Toronto Dominion. Other than that, shorting a stock is simple. Doing the transaction is not difficult and can be done by someone with minimal investing knowledge. However, it should only be done by those who follow proper risk management protocols and are willing to take on that burden.

The Advantages and Disadvantages of Shorting A Stock

Pros

There are many advantages when partaking in a short position. The first is that you can hedge your bet. This means that if you’ve previously purchased a stock and it crashes, you can short the position. If you do this, you’ll lose money on your initial purchase investment. However, you’ll earn a profit in the short position. Therefore, you can actually come out positive if you hedge with enough capital.

Next is the fact that you don’t have to use your own money when shorting a stock. This is due to the fact that you borrow the shares from the broker, then sell them and receive money. Therefore, once you’ve bought the shares back, you would not have spent a dollar of your own money. However, there is a caveat to this. Most short positions require a daily fee to maintain that position. However, depending on your position, this may not amount to much.

Lastly, shorting stocks allows you to earn a substantial amount of money within a bear market. Currently, at least at the time of this article’s inception, the market has just gone through a massive downturn. Certain stocks have lost up to and exceeding $60 in their share price. Now, imagine if you had a short position on a stock like Redfin. On Feb 22nd, the stock peaked at $97 USD per share. As of Feb 28th, the stock is just above $75. Nearly a $25 difference. If we were to round off the amount to $25 per share and use the 100 share example used before, you could’ve earned a $2,500 USD profit in a matter of 7 days. That is a clear example of using the concept of shorting to turn a major profit within a bear market.

Cons

Shorting a stock carries a few disadvantages. The first is that you have to pay fees. While the fees may not seem like a substantial amount, they do add up if you’re holding the position for an extended amount of time. You can end up pay hundreds of dollars for one position.

Next is a margin call. This is more of overall concern for margin accounts. Essentially, if you short a stock and the value of your position falls below the margin accounts requirements, you’ll receive a margin call. This means that you will either need to close the position or add more funds into the margin account so that it maintains its balance.

Lastly is your potential for loss. If you purchase a stock, the only money you can lose is the amount you invested. Therefore, if you’ve invested $10,000, that is the most amount of money you can lose. However, when shorting a stock, it can go up endlessly. Therefore, once you’ve reached the end of your short position’s life span, you can end up paying substantially more than your initial investment. For example, let’s say you have a $10,000 short position on 100 shares for $100 each. Let’s say that $100 stocks get the GameStop treatment and go up to $400. You will now have to pay the initial $10,000 back, plus an additional $30,000. Therefore, only those with an adequate amount of knowledge and risk management should consider such a tactic.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.