What Is Going On With The Stock Market

For those who don’t know, the stock market is an extremely volatile place. While this is true, there are many ways to earn money through the stock market, in terms of strategies. Furthermore, depending on the stocks and ETFs you invest in, you can have pretty sustainable growth in your portfolio. However, the stock market is volatile due to how unpredictable it can be. Crashes and corrections happen quite frequently. However, the problem most people have is not knowing when it’ll happen. While there are a lot of indicators that can predict a stock market crash, they are not 100%. If you could predict the market with 100% certainty, you would most likely be one of the richest people in the world.

With that being said, if you’re familiar with the stock market, you may be wondering what has happened within the last week. If you’re one of the people who haven’t noticed, the stock market essential crashed. While a “crash” might not be the correct word for it, the market definitely went down a considerable amount. Some people may look at this and think that there is no reason for the stock market to take such a huge dip. However, there are several reasons we can look at that’ll give us an indication as to what happened. Before we take a look at what caused the market to take a nosedive recently, we will look at what caused the market to crash last year.

What Happened During The Year?

The year 2020 has been turbulent, to say the least. This was the year that Coronavirus started to become a major concern. Therefore, the whole world went on lockdown. With only essential services remaining open, everything else closed down. This means no international flights and even some fast food places closed their doors. For some, this was a nice break from working but for others, it was massively devastating. While many countries have gone back to normal and some have kept the cases down to a minimum, others are still feeling the effects of the virus. For example, here in Toronto, many services are still under lockdown. Restaurants still do not have dine-in services and various other amenities are closed.

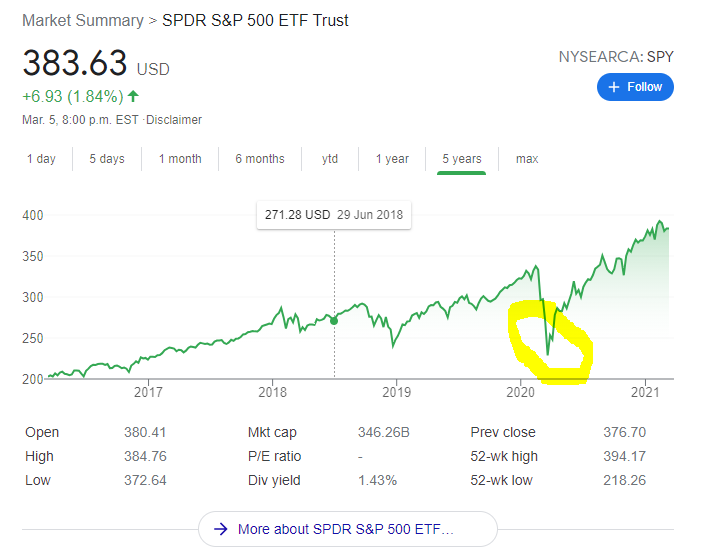

So, what are the consequences of such an event? The stock market taking one of the biggest downturns seen in recent years.

Above is a picture that outlines the SPY ETF or the fund that tracks the S&P index. Typically, the SPY follows the market pretty closely. In the broad sense, whenever the market is doing well overall, SPY will follow. However, if there is a major economic downturn, SPY will also follow. If you were to look at the Dow Jones industrial average over a 5-year length, you’ll see that the patterns are nearly identical. However, if you look at the picture, you’ll see a yellow circle that indicates the start of the pandemic fears and everything closing down. This dip in the market nearly reached a 5 year low. This caused many stocks to plummet in value to record lows. Furthermore, those with TFSAs and RRSPs most likely noticed a substantial dip in their portfolio during this time.

While this was the case then, you can see that the market has recovered quite considerably. Furthermore, it even blew past the previous highs before the Covid crash happened. So, what’s happening now? Looking at SPY, you will see that right now, even though the market took a large dip, it’s not anything close to what happened last year. For example, the Tesla stock, during the beginning of Covid, took around a $30 dip. However, since the beginning of the year, the Tesla stock has dropped down over $400 (at the time of this post’s inception).

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- From Hello To Hired: Breaking Through The Interview

- Why You Should Open A Wealthsimple Account

- How To Start Your Very Own Blog

- How To Market And Monetize Your Blog

What Made The Stock Market Dip?

One of the reasons why the stock market is taking a significant dip right now is due to treasury bonds. Due to the fact that the yield on bonds is going up, more people are finding this investment appealing. Therefore, they take their money out of shares and put it into a bond that’ll almost guarantee some sort of return. Although to many people, bonds might not be as appealing due to their low rewards. However, for many it is. Therefore, once people start collectively pulling their money out of shares to invest in bonds, what happens? Stock prices start to decline. This can be rapid or happen over a period of time. Looking at it from a risk management perspective. Why would you take the risk of investing your money into an ETF when you can have the lowest risk possible and still earn a reward?

The stock market, in correlation to bond yields, is relatively reactive. This means that’s if bond yields reach a certain percentage, the stock market tends to sell off in a reactionary measure. For example, anytime the 10-year bond yield passes 1.5%, the market sells off in reaction to this occurrence. As you may have assumed, the yield percentage has been going up since mid-February. Therefore, the market has been selling off. Aside from that, Federal Reserve chairperson, Jerome Powell spoke in an interview which also caused the market to take a sharp dip.

Why Are Percentages Increasing and What Are Bonds?

A bond is an investment that carries a low risk to reward ratio. Essentially, you purchase a bond for a set price. Let’s say $1,000. That bond will last 10 years and pay you 2% every single year. Therefore, you will receive $20 every year from that $1,000 investment over the span of 10 years. This will result in a return of $200 over 10 years. In its simplest form, this is what a bond is. Companies and entities like the government use bonds as a way to accumulate money. Think of it as giving a loan. You send off the money with the hope that it’ll come back in installments with interest attached to it. A very low-risk investment. However, no investment is risk-free. There will always be some sort of risk involved.

So, why are the yields increasing? The simple answer is due to the fact that no one wants to purchase bonds. If bonds are being sold and no one wants to buy them, what would naturally happen? Prices on the bonds will go down and cause the yields to go up. Similar to a clothing store. If an item is not selling, you reduce the price to make it more enticing to customers. Bonds work in a similar way.

Let’s revisit the example I just gave. Where the bond is $1,000 and you get $20 per year over a decade. We will make the example extreme just so it’s easier to understand. Let’s say no one is buying the bonds exemplified above, suddenly the government or company will decrease the price of that bond, causing it to be cheaper have a higher yield. Previously, it was a 2% yield of $1,000. However, what if the bond price decreased to $500? Suddenly, you’ll have an increase in yield percentages and an influx of people looking to purchase bonds. This is due to the fact that now, not only are they paying 50% less for the bond ($1,000 to $500), but they’re getting double the return. The bond will still give you a $20 return annually. However, since your initial investment is now $500, you will be getting a 4% yield.

Hopefully, this clears up any confusion as to why the stock market has been taking a major downturn recently.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.