How Much Money Can You Earn From Day Trading?

The stock market. A vast and sometimes jarring concept to many people. However, what some people don’t know is that it can earn you a serious amount of money. One popular way of doing this is trading stocks. However, there are many different methods in which an individual can go about trading stocks. Therefore, it’s only natural that some methods are better than others. However, this does not mean that all methods don’t have their positives and negatives. Day trading is a method in which you trade stocks. However, it is relatively glorified.

How much can you earn as a day trader? Well, that’s what we’re going to take a look at. However, before we dive in, we need to see what exactly day trading is and how you can get into it. If it isn’t already obvious, if you decide that you want to become a day trader, you’ll need a lot of preparation and knowledge. More than this article alone can offer. This article’s purpose to merely inform you of what day trading is and it’s potential.

What Is Day Trading?

As a day trader, you’re attempting to maximize profit throughout the day. The stock market is only open for a limited time. Therefore, you have a window of opportunity. There is a concept of pre and post-market trading. However, this can be talked about in an entirely different section. Therefore, for this article, we will stick to the regular trading hours of 9:30 am – 4:00 pm eastern time. This will make it easier to follow and understand. Now onto what day trading is.

As a day trader, your job is to purchase and sell stocks based on the minute fluctuations on a stock price. This is done in repetition in order to garner a larger income. When going about this method, there are many strategies that you can follow. If you were to google day trading, you’d most likely find a plethora of different courses and strategies that you can follow. I can’t give you any advice on which one would be best. However, I can give you some advice on a few key rules to follow if you are going to day trade.

First, day trade in a market you understand. If you understand the market and companies you’re investing in, you’ll be better equipped to deal with any fluctuations. People often underestimate the importance of this. However, if you’re going to invest in a company you know nothing about and hope the stock rises in price, you’re essentially gambling.

Second, read relevant articles. Often times, articles about a particular company will come out. This information can increase or decrease a stock’s price. Furthermore, articles or news can set a daily trend for how a stock may act. Therefore, if you read the news, you can avoid any mistakes that may happen throughout the day.

The point of day trading is to consistently sell and buy stocks throughout the day for a profit. There are a few books that you can read that’ll help you advance your knowledge in the field.

Related Articles

- 4 High-Return P2P Lending Platforms For Canadian Investors

- Highest Paying Trade Jobs In Canada

- From Hello To Hired: Breaking Through The Interview

- How To Know When To Invest In A Stock

- 4 High Paying Jobs That Don’t Require A Degree

- Top 9 Best Assets That You Can Own

How Do I Get Into Day Trading?

Getting started in day trading is actually quite simple. You don’t need much in terms of equipment. Technically all you really need is a phone. However, this would not be the most efficient setup. However, the most important asset you need in order to start day trading is capital. The more money you have increases the amount you’ll be able to earn. However, there is a downside because this also means you’ll be able to lose more. The amount you gain or lose will depend on how much money you’re willing to invest in per transaction. For example, a stock opens $10 per share, you invest $1,000 at 9:00 am and sell at $11, you’ll have earned $100. Although, finding a single stock that increases that much is extremely hard. Furthermore, you can just as easily lose that $100 instead.

If you were to invest in 10 different stocks with varying price points, you’ll be effectively diversifying and mitigating your risk. Since day trading can be volatile, having multiple positions can help you maximize profits while minimizing losses.

It is a common notion that day traders lose much of their profits. The video above outlines a few ways as to why day traders lose money. If you’re thinking about getting started, definitely check out this video. It’ll help you become more informed and avoid any pitfalls that you may encounter. Of course, you’ll lose money. However, the purpose of day trading is to gain more than you lose. Start off with YouTube videos like the one above. After that, move onto books.

Lastly, join a website that has fake money and try your hand at trading fake money. That’ll help you acquire a firmer grasp on the concept of trading stocks.

How Much Can You Earn From Day Trading?

Day trading is quite a difficult profession to gauge in terms of income. Most day traders lose money and many don’t report their income. However, there are a few reports on Glassdoor where they’ve reported an income of approximately $50,000 per year. However, a good way that we can look at how much money a day trader can earn is through Investopedia’s example.

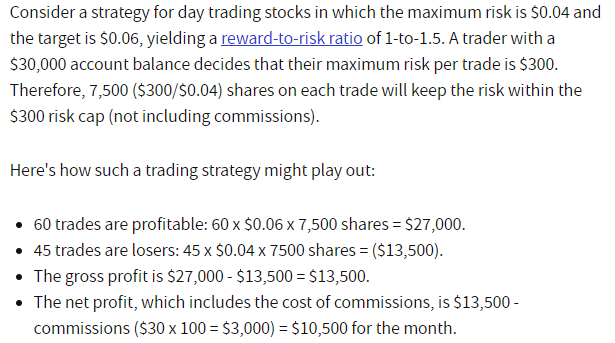

As you can see, the above example goes off the assumption that you’re day trading with a large amount of capital, $30,0000 to be exact. Day trading is extremely calculated in the sense that you’re expecting to make a large number of trades and have a set amount of risk. As you can see, the example above exemplifies a strategy where you profit off 60 trades and lose 45. However, the profit is only marginally higher at $0.02 per share. However, you’re trading $7,500 shares.

It is important to remember that this is not an exact example. There are various stocks and price points that you’ll be looking at. Although it has already been reiterated, I can’t stress enough how important following a particular plan/strategy is. Furthermore, you need to not get tilted. By tilted I mean investing money, losing, and potentially doubling down in order to recoup what was just lost. This is a common practice within the gambling community and it caused people to lose thousands – millions of dollars. The key is to not be emotionally attached to the money you’re investing. However, you must be calculated. If you’re trading based on emotion, you’ll make most likely make poor decisions. When dealing with money, statistics, and probability, logic is your best friend.

Conclusion

In conclusion, day trading can be profitable. However, it takes a lot of time, money, effort, dedication, and mental fortitude. Becoming successful/profitable can take a long time. However, if you follow a strategy, stay logical, and learn from your/other’s mistakes, you should have a fun time. One last thing to remember is that unless you’re investing within a tax-free savings account, you will have to pay taxes on the money you earn. Therefore, if you’re consistently profitable, set some money aside for when the tax season rolls around.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.