Keeping Your Credit Card Information Safe

I’m willing to bet that you, the reader, own or know someone who owns a credit card. These pieces of plastic are pivotal in our everyday lives. Although, they can be a huge burden if not used correctly. This is why being financially literate is a must in our current society. However, safety is also a must.

During my time of working with a bank, credit card fraud was an everyday occurrence. honestly, there were some days where it seemed like I was only getting calls where people had their information stolen. Hackers and scammers are constantly finding new ways to steal your information. Therefore, we’re going to walk through a few ways that people commonly get their credit card information stolen.

Credit Card Fraud

Before we get into what to do to avoid credit card fraud, we must first identify it. Credit card fraud is when someone gets your personal information and uses that information to purchase items or services. This can be done on a large scale. The scary thing about it is that it can be hard to find the perpetrator. Since there are so many ways to mask your identity and stay anonymous, a lot of these fraudulent acts go under the radar.

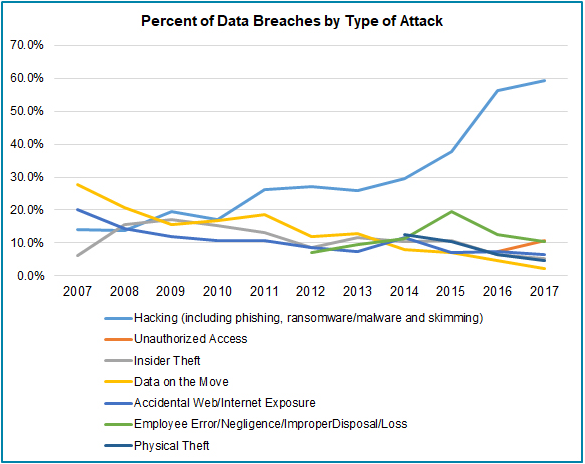

In the graph above, you can see a clear increase in hacking over a decade. Of course, this is due to the rapid growth of the internet. However, this just means you need to be safer and made aware of everyday dangers.

Although there are safety nets in place to help the average consumer be protected from data breaches, it’s not nearly enough. This is due to the fact that if a group of people has enough time and resources, they can most likely find a way to get your data through third parties, such as banks.

Although, if your information/money is stolen you can always dispute it with your credit card company. Also, sometimes the banks are notified of suspicious behavior on your credit card and block it from being used. However, their investigations can take weeks and getting your money back may take months. Therefore, preventing theft from happening is much better than solving it when it does.

Related Articles

Don’t Share

The first and most obvious step to take is to not share your information with anyone unless. This means family and friends as well. Although you may trust someone, you never know their intentions. Furthermore, if they have your credit card information, they may accidentally release it. This can create a huge problem because not only will your credit card information be release but it’ll become increasingly hard to find the culprit.

There have been many times where people would call in and their own family members would use their card without them knowing. This would result in a large amount of debt and a negatively affected credit score.

If your credit score happens to be effected, that may take months to resolve as well. Therefore, don’t tell anyone your information or send any kind of pictures.

Lastly, you’ll have to change your credit card number if you’re a victim of fraud. This means that all of your preauthorized payment information will have to be changed individually. This can be a colossal headache. Avoid doing it by not sharing your information.

Outbound Calls

This is a huge reason why people get scammed or have their data breached. Outbound calls are when people call you, say that you owe money or won a trip. After this, they’ll ask for your banking/personal information. With this, they’ll be able to funnel money out from your card. There was also a huge scam going around where people would call and say they’re from the IRS or CRA. They’d ask unsuspecting individuals to load money onto an iTunes card in order to pay their taxes. These scammers were able to steal millions.

If you can any call like this, I’d suggest to politely hang up and contact the appropriate number. For example, if someone calls you and asks you to pay your taxes, end the call and contact 1 (800) 959-8281 (CRA’s phone number). This way, you know your information is safe and secure.

This can also happen with telecommunications companies. It’s true that they have telemarketing teams that do outbound calls for promotions. However, if they’re calling you they should not ask you to verify any information. If you ever feel uneasy, hang up and call the company back at their regular phone number.

Emails

Another perpetrator is emailed scams. These emails will look real but be absolutely fraudulent. Also known as phishing schemes. These come in all sorts of ways. A family member I knew almost fell for one hat said that a company owed them a refund. Other emails say that you owe your bank money or even that you won some sort of give away. To put it simply, legit companies will not ask for your information in an email and will not send you unsolicited emails.

I remember a time when I almost got scammed. The scammer sent me an email that was from PayPal and I looked completely legit. However, I was also new to PayPal and did not know how it worked at the time. Long story short, I figured out it was a scam at the last minute. From there I decided to become more aware of these types of emails. Here is a sample picture of a fake Amazon email.

Some look obvious but some will look identical to the real ones. Just remember to not follow any unsolicited links that ask for your personal information. Remember to check the email address. If you have any questions, you can go to the website directly and either call them or contact their customer support through other methods.

Websites like Gmail and Outlook do a good job of filtering out spam and phishing emails. However, it would be advantageous to take that extra effort and ban any suspicious-looking emails that may have gone through. There are bound to be some emails and phishing attempts that’ll slip through the cracks.

Text Messages

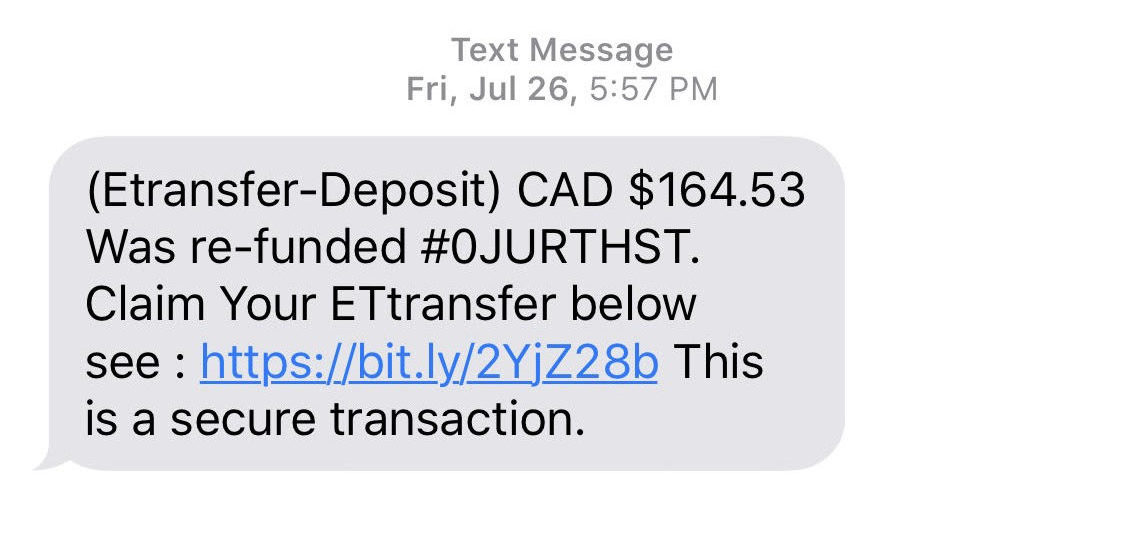

Text messages are not as common. However, they do happen. There will be a message that says something along the lines of “There is an alert on your account” or “A charge has been made on your account”. The text message will be ended off with a link for you to follow in order to input your information. As you can see, all these scams follow a very basic formula. They’re based on tricking people into inserting their information in order to exploit them.

Above is a text message that I personally received which is a clear example of a text message that is after your personal information. There will be links similar to the one above. Once you click it and insert your information, they have all the information they need. Be careful of these text messages and never click links sent to you by unknown numbers.

Malware & Ransomware

Lastly, hackers can access your information through malware. Malware is a virus that hackers can install onto your computer. In many instances, they can keep track of all your passwords, credit card information and log in details. I actually had a run-in with malicious malware (I clearly was not knowledgable).

I had downloaded something earlier in the week and had gotten a virus on my computer. This virus allowed the hacker to track my information and access my computer remotely. How do I know this? I caught the hacker while he was remotely accessing my computer.

I left my computer on one day and when I came home, I saw the hacker moving my mouse and logging into my PayPal account. Although I had nothing in it at the time, it was still scary to see. However, instances like these are common. Hackers can do these things and more through various methods. These methods can be as simple as downloading software or even opening an email.

If you ever experience any difficulties with viruses, a few programs that I would suggest are CCleaner, Malwarebytes, Rogue Cleaner, and Adw Cleaner.

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.