How To Save Money During Christmas

Its that time of the year again, Christmas. That means a lot of spending and joy. However, it’s important to not overspend and be financially responsible during this time of year. We will discuss a few ways on how you can stay financially stable during the Christmas season. Fortunately, this will be a relatively short article. That way, you will be able to get all that shopping and saving done. Without further ado, let’s get right into the content.

Spend Money You Have

One very important rule to follow when going about your holiday shopping is to spend the money you have. This means that you should NOT go into debt. This does not mean that you shouldn’t use your credit card when making these holiday purchases. On the contrary, it would be an amazing idea to use your credit card. This is due to the fact that you will build credit the more you spend. However, you need to be careful because it is easy to rack up debt without a way to pay it off.

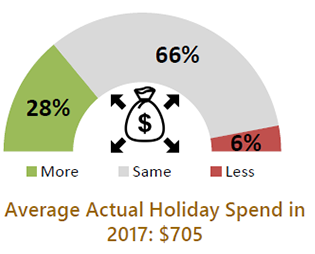

Canadians, in 2017, spent an average of $705 during the holiday season alone. The meter above is actual holiday spending vs anticipated or planned. The green signifies that 28% of people spent more than they anticipated. Whereas, 66% spent the same amount while 6% spent less. All this equates to $705. For many people, this is a large amount and even more than their two-week paychecks. Be wary of how you spend your money and even more cautious of how you’re going to pay it off.

Many people have the mentality of “out of sight, out of mind” or that they’ll deal with the debt later. However, this is extremely detrimental. As soon as you start accumulating debts and making minimum payments, interest starts to build. This is the start of a vicious cycle that leads people to lose their houses and other assets. Working at a bank, you will see many people who have crazy spending habits. Maxed out credit cards with a third of that amount within their bank account.

I remember a few ladies called in and wanted to cancel their credit cards. They were so far in debt, their only option was to consolidate and close their cards. They pay the minimum payment but interest gobbles it up. The point is to create a budget and follow it exactly. This budget will help you from drowning in a pool of debt.

Related Articles

- 5 Ways To Save Money

- High-Interest Savings Accounts That You Should Have

- Learn About Credit Card Interest

- Want To Sell Your Items? Try These Apps & Sites!

Make Gifts At Home

Making gifts at home can be an inexpensive way to bring joy to someone during the holiday season. It truly is the thought that counts. There are people out there who would prefer an expensive gift. However, most people are happy with whatever they get, especially if its something you created. That means you went out of your way and put in more effort to create something. These types of gifts, in my opinion, are priceless. There are virtually limitless things that you could make for the receiver of the gift.

Above is a video that’ll give you a few ideas of what you can make and how. Some other ideas for you are candles, snow globes, food or even ornaments and decorations. If you’d like some more DIY Christmas gifts, here are 85 of them from countryliving.com. I know it’ll take a lot of effort. However, saving hundreds of dollars may be worth it. Another positive is that if you know the person really well, you can even make them something that they may need. Always take every possible option into consideration.

Save When You Can

Many people look at Christmas as an excuse to spend the money wherever they can. However, it is absolutely critical that you save whenever you can. People underestimate the power of saving and how much it can really change your life. I was never a fan of saving. However, once I started budgeting myself and buying things that I needed on sale, my debt started to decrease drastically. There are many ways you can save money when buying Christmas gifts.

The first way we already talked about and that is creating your own gifts at home. Another way is traversing through discount websites like Groupon and Rakuten (formerly eBates). These websites can save you hundreds of dollars, depending on how much you purchase. For example, I went to Casa Loma recently. The tickets for the event that was happening there was $45 each. However, with our savings from Groupon, we effectively saved $15 PER TICKET. That works out to a 30% saving just from purchasing the tickets from a third-party site.

Another way you can save is by purchasing items from local. This is also a good way to earn a bit of money from spare items in your house. There are many popular sites that allow you to buy used items such as eBay and Kijiji. Both are websites that act as a pipeline between seller and buyer. However, Kijiji focuses on buying items face to face. Purchasing used items can save you hundreds to thousands of dollars. However, you must be extremely careful because people have a tendency to lie or distort the truth in order to make a sale. EBay has buyer protection but Kijiji does not. Keeps these things in mind.

Save In Advance

Another thing you should do is save in advance. However, I’m not talking about periodically dipping into your savings to pay for holiday gifts. I mean you should save specifically for Christmas. This can be done in one of two ways or both. Know what you’re purchasing for everyone and saving a specific amount or estimate the amount and save a large sum. I’m more in favor of the former because it takes more effort but you’ll have a rough estimate of how much you’re going to spend.

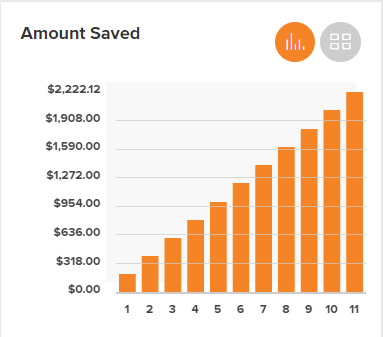

Saving $100 from your paycheck every two weeks can accumulate to a lot of money towards the end of the year. Theoretically, if you were to save $200 a month, you’d save we’ll over two thousand dollars without it being in a high-interest savings account. Although, saving two thousand dollars just for Christmas may be overkill. Therefore, save how much you feel comfortable with. Whether it be $20 a month or $200.

Just to give you a bit of an idea of how much saving with a high-interest account can earn you. If you started out at $0 and saved for 11 months, you’d accumulate $2,200. However, if you put into a high-interest savings account, you’d earn an additional $22.12. Although it may not seem like much, it adds up. and can be seen as free money.

Hand Me Downs/Recycle

If you’re really strapped for cash or want to give something sentimental, you can always re-gift. I know it’s frowned upon but it’s a sure-fire way to save a little extra cash. Furthermore, if its something really nice that you don’t have a need for, chances are the other person will appreciate it. As they say, one man’s trash is another’s treasure.

This works well with perfume, unworn clothing (remember to take off the tags) and even electronics! Sometimes giving money and a nice card can be a great way to save money and time.

This has been a quick article on how you can save during the holiday season. Have a great holiday and we’ll see you again next week!

Merry Christmas!

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.