How Important Is Long-Term Real Estate Investing?

Almost everyone these days has the dream of investing in real estate. However, many people are unaware of how important real estate investing is for your overall portfolio. There are those who’ll advise you against real estate investing because it can be risky. However, I believe that the reward far outweighs the risk. We will be taking a look at a few factors when it comes to real estate investing. Hopefully, this article will help you become more informed when you do eventually invest in real estate!

Real Estate Appreciation Over Time

Every investor hopes that their investments will pay off over time. Long or short-term, this is always the case. The term for this is appreciation. Real estate is known to be an amazing investment. The value of your property tends to appreciate well, depending on a number of factors. First, your property will increase in value if you’ve bought it in a new area. Secondly, if you do any renovations, namely to landscape, washrooms, floors, kitchen, and finishing a basement.

A great example is my previous house. We bought the property for $297,000 in 2009. By the time we sold the property in 2017, it was worth over $600,000! Quite the investment right? That’s an over 200% increase for 8 years. This was possible because the house we bought was in a newly developing area. We then completed the basement, painted, redid the flooring and carpet. How many investments give that type of long-term growth?

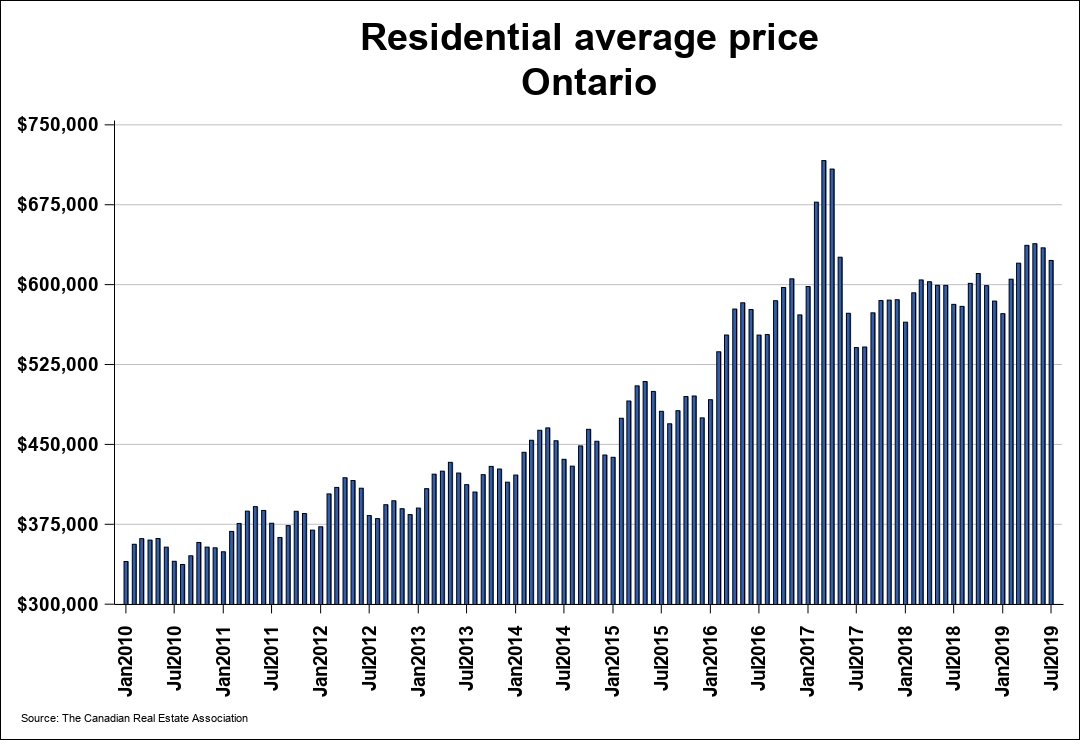

As you can see from the graph above, provided by The Canadian Real Estate Association. You can see that there is a clear upward trend for average residential prices over the past 9 years. Starting in July of 2010, to July 2019, prices have quite literally doubled. Of course, like any investment, there is a risk. Real estate isn’t a very liquid asset. However, if you have patience, look for a great property, educate yourself on the process, you will experience why so many investors love real estate.

Related Articles

- Real Estate: Buying Vs. Renting

- 8 Ways To Make Money Through Real Estate

- How To Pick Your Perfect Home

Average Monthly Cost Of Renting

As many people are aware, when you purchase an investment property, it’s used to generate a source of income. There are people who purchase properties who do not intend to rent it out. Furthermore, there are investors who love to purchase houses and flip them in order to turn a large profit. There are many ways to invest in rental property. However, the most popular way to invest in real estate is to purchase a property, rent it out or house hack and let that income pay off your property over time.

Not only will your property be getting paid off but you’ll generate a side income. Ideally, the income you receive from your rental income should be enough to pay off all bills and damages that may occur. Furthermore, you should also be able to profit from that property. If you can manage to profit $1,000 per month form your rental property, that would be great. However, realistically you’ll want to garner at least $200 per month from that property.

Example

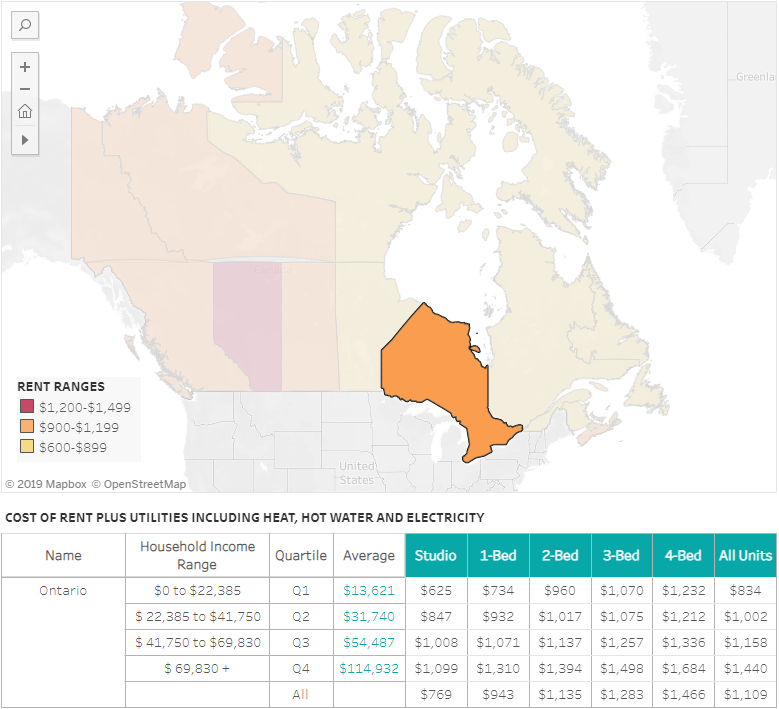

Let’s take a look at the rental cost per month for Ontario:

The average cost of rent in Ontario is $1,109. In more populated areas, like Toronto, the average cost of rent will be significantly higher. However, let’s say you purchased a property where the average cost of rental in that area is $1,283. You’ll need to have all of your bills equal to less than that amount. This way, you’ll profit. This sounds crazy if you’re living in or around the Greater Toronto Area.

The goal is to acquire a rental property where the mortgage and utility payment is less than the rental income you’ll be acquiring. This can be done by having a good credit score, high monthly income, large down payment, and good credit history. However, you can also purchase a rental property that is fully paid off. Finding a unit where you’re able to do this is quite difficult. However, if you have patience and a real estate agent who has your best interests in mind, you shouldn’t have a problem.

Popular Opinions

Everyone has an opinion. There are those who are for and against real estate investing. Each has its own particular reasons for their point of view. Since real estate is such a large investment with a relatively high risk, people tend to shy away from it. Furthermore, if the housing market crashes again, you could lose a lot of money.

Although there are a lot of benefits to investing in real estate, it is important to outline the downfalls. If you know the downfalls then you will be able to mitigate any risks that may come your way. Let’s take a look at some quotes about real estate:

As you can see, there are many people who’re outspoken about the advantages of real estate investing. If you want more quotes, click any one of those two images above. Just remember, do your due diligence and educate yourself. Just like stocks, bonds or ETFs, you should invest without knowledge. If you can quire guidance, you’ll be one step ahead of most.

The Housing Market

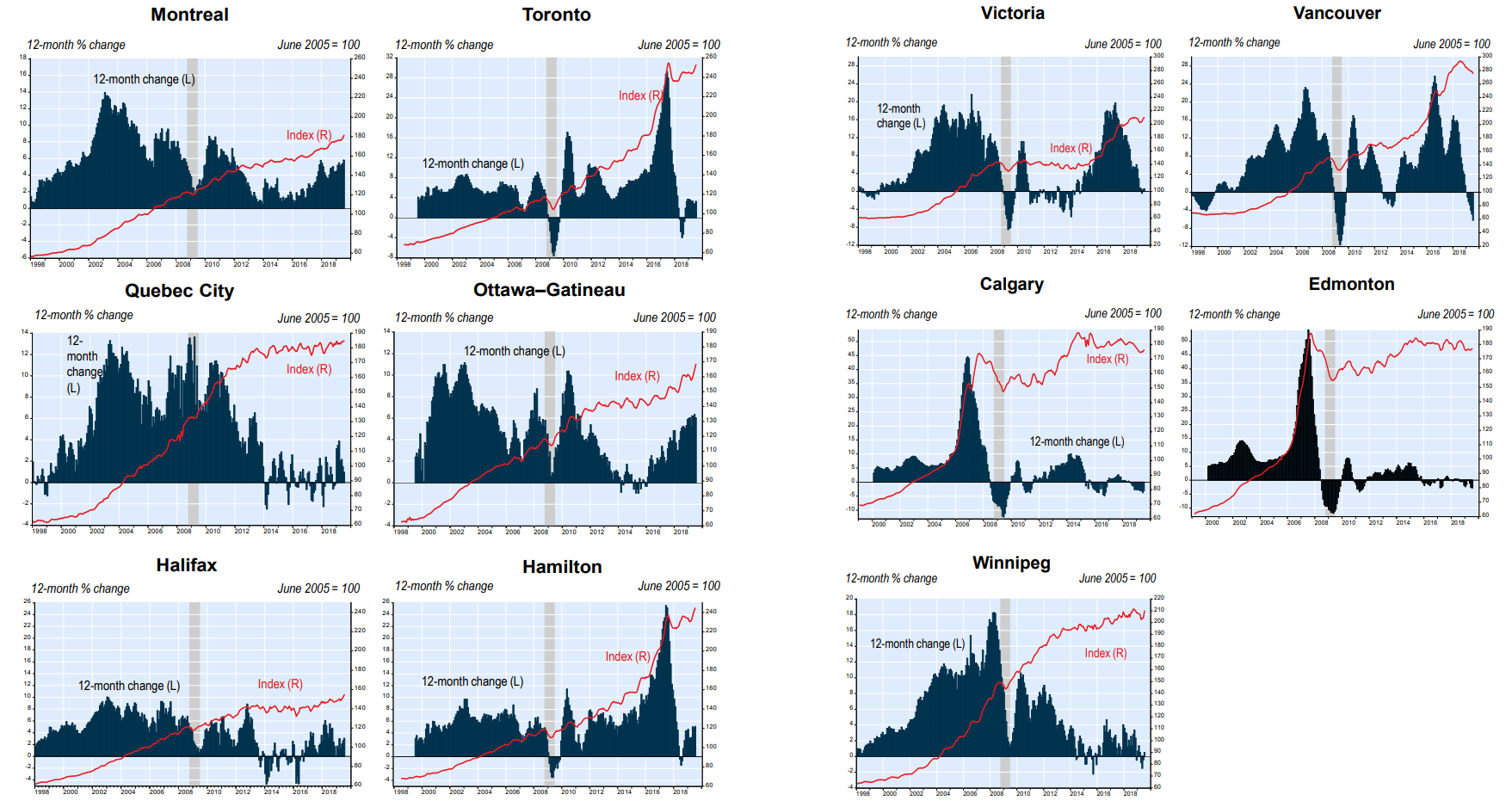

The housing market is always in flux. There are good times and bad times to buy. However, aside from when the market crashed in the late 2000s, the market has been in an upward trend. To exemplify this, below will be a graph from the Tarent- Nation Bank Of Canada Price Index. (Click the picture and zoom in if you’re having trouble seeing).

It is evident that the housing market has been on a clear upward trend for the past 20 years. While there is a clear decline recently, it’s safe to say that the market will progressively trend upwards. That’ll make any property you buy, especially now, appreciate greatly in the long run. Investing in real estate is a waiting game. Although you are and should make money when you buy. Real estate investing is generally a tool used to grow long-term wealth. There are many people who retire on their rental property income alone.

To clarify for those who don’t understand the concept of making money when you buy. If you find an undervalued house in a particular area with a higher average value, you’ll make money in equity.

For example, purchasing a house for $350,000 in an area where the real estate generally sells for $400,00 – $425,000. You know have made $50,000 because you found a good deal. However, properties are sometimes undervalued for a reason. Therefore, if you’re planning on renting or selling, you’ll most likely need to do some work to the property.

Cash-Out Refinance

Before we end off, I want to briefly address a cash-out refinance. A cash-out refinance is when you replace your existing mortgage with a new loan that is higher than your current one. Once this is done, the difference between your current mortgage and the new loan is given to you. For example, let’s say you’ve built up $250,000 equity on a $500,000 house. You can refinance your house, making your new mortgage $500,000 again. However, that $250,000 equity is now given to you as a lump sum.

As you could imagine, this can be used as an incredible tool. Renting out a property, building equity, then cashing out to in order to acquire a new property. This shouldn’t be done often. However, if the numbers make sense and you’ve done your due diligence, you can build wealth through real estate at a faster rate.

Cons

There are some cons when it comes to cash-out refinancing. For one, every time you do it, you’ll have to pay a closing cost. This percentage is usually around 3% – 4% of your loan. Therefore, this is something to definitely consider.

Second is private mortgage insurance. When you borrow past a certain threshold, usually 80%, you’ll pay a fee each year. This fee can vary but usually does not go past 2.3% of your loan. It may not seem like a lot of money but I can assure you it adds up over time!

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.