Why A Budget Is Absolutely Necessary

One of the hardest concepts for many people to grasp is budgeting. This is even more prevalent with the younger generation. In an age where new technology is coming out at the blink of an eye, it’s difficult to stay on track and become frugal. Having a budget is quite an accomplishment. However, it’s an even bigger accomplishment if you’re able to maintain it. For those who are still wondering why they need a budget, we will address that concern. Therefore, sit back and relax while we discuss what a budget is and why it is absolutely necessary.

The Purpose Of A Budget

The purpose of a budget is very straight forward, to save money. Often times, you’ll hear wealthy people say that you shouldn’t budget. That its a waste of time and it’s stopping you from living your life. I would like to respectfully disagree. I believe that you can have a budget while still living your life. However, there needs to be moderation.

In order to save money and access your goals, you need discipline. Not all of us are born wealthy and many people have a habit where they spend more than they make. The purpose of a budget is to not only help you reach your goal but to help you become more financially stable.

Those who’re on the journey to financial freedom miss this step and for good reason. Budgets are hard to maintain and are by no means meant to be easy. However, they’re necessary. It is true that you can win the lottery tomorrow and suddenly have millions of dollars in your bank account. However, without financial literacy and disciplined spending habits, you can be apart of the statistics of people who go bankrupt after winning.

The best way to gain this type of discipline is to start budgeting. Start off with something small like saving for a car or reducing the amount of money you spend on groceries. Then, work your way up to something bigger like saving for retirement. It’s a journey and we all budget in one way or another. However, becoming aware of your spending habits is a power that many people have not mastered.

In short, the purpose of a budget is to reach your goals, gain financial literacy and take control of your life.

Related Articles

- Why Saving 10% of Your Income Is Not Enough

- 5 Ways That You Can Save Your Money

- How Important Is Long-Term Real Estate Investing

- High-Interest Savings Accounts That You Should Have

Why Are They Necessary?

The obvious answer is that they’re necessary because without them, we’d all be broke. As I stated earlier, we all budget in one way or another. Some of us try not to spend too much money on outside food. Other would rather stay home than spend money. Even if you’re intent is not to save money when choosing to stay home, you’re still technically budgeting. That money that could be spent on mindless entertainment or drinks can now be saved and used in the future. Money, in many ways, is power. When you budget and save money, you’re increasing the amount of power you have.

Have you ever heard of the term “It takes money to make money”? Well, if you save your money, it has a chance to grow. When it’s growing, you’re building capital. This capital can be used to invest or even purchase some sort of assets like a house or even a car (depreciating asset). Maybe investing isn’t your thing. Saving for travel is a popular option, especially for the younger generation. The snowball effect that’s caused when budgeting is monumental. It’s not enough to just earn more money. Think of earning and savings as two sides to the same coin, they go hand in hand.

Think to yourself right now, what do you want in life? A house, car, trip, better job, healthier food or maybe that new iPhone. Whatever it is, that’s your goal. Next, think about how long it’ll take you to acquire that goal. Some goals may take months to achieve and others may take years. However, any and all of your goals are attainable.

Your budget decides how your income is allocated. Through the knowledge of knowing where your money is going and when you can adjust it to your liking. With this power, you can get that car you want within a certain time-frame or take that vacation by next year June.

Example

If you’re 20 years old, working for $17/h and your goal is to buy a house to by 25. You’ll probably need to make some changes. Although this is a lot of money, especially at 20 years old. The main thing that you’ll need to do is adjust your lifestyle accordingly. Let’s say that you want to save $50,000 in 5 years for a down payment. Sounds simple, $10,000 a year and $17/h adds up to $34,000 per year before taxes.

After-tax, $34,000 a year turns into roughly $27,700. Minus that $10,000 per year, you’re now living off of $17,700 per year or $1,475 per month.

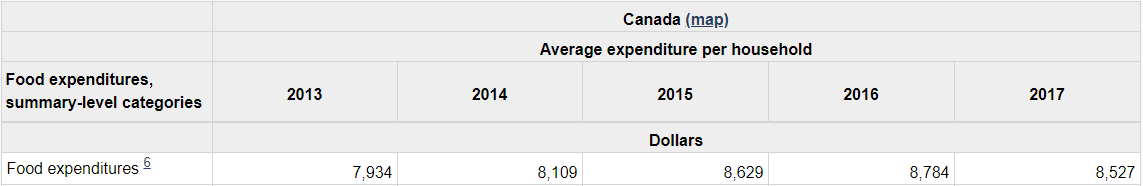

The average Canadian household spends around $8,500 per year on food. That’ll make your $17,700 dwindle to $9,200 per year or $766 per month. Lastly is rent. The average cost to rent in Ontario is roughly $1,209 per month. This’ll definitely put you into the negative ($443). However, this is all based on the notion that you’re 20 years old and living by yourself making $34,000 a year.

Let’s take a look if this person were to budget. Our example cuts their expenses down by meal prepping and strictly buying essentials. I’d say we can bring that $8,500 down to $4,500 ($375 per month). Furthermore, this person begins the house hack or live with roommates, cutting their $1,209 rent per month down to $700. That’ll put our example at an excess of $400 per month. Although that isn’t much, it shows that someone can definitely reach their goal. Even if you’re in the negatives, there can be a way to put you in a surplus.

Everyone’s situation is different. If you’re making $34,000 per year before tax and have little to no expenses than acquiring a house may just be plausible. However, if you were to cut down your expenditures in food and transportation, chances are your likelihood of reaching your goal will increase exponentially. So much to the point where you could track exactly when you’ll be able to reach your goal. That’s the beauty of budgeting. If you’re budgeting, you take away the element of surprise and are always prepared.

How To Budget

There are many different ways that you can budget. However, it all starts with you taking a holistic view of your current lifestyle. The first step before saving is knowing what you’re spending and when you’re spending it. In the modern age of subscription-based services, money comes out of the average person’s account without them noticing. This ease of mind is a double edge sword. While we’re able to not dwell on it, we tend to forget. Therefore, download an app like Mint so you can know exactly when your money comes out and how much.

Next, set a goal for yourself. It can be anything from a vacation to a new house. Although you don’t need a goal to start budgeting your life, it’s good to have some sort of incentive. A great app for this is Mylo. Mylo allows you to save and invest in your own goals based off of your income and spending habits. The best part is that the app automates saving. They round up all your purchases to the nearest dollar and save/invest the difference.

Lastly, analyze your spending and reduce the costs of things that aren’t necessities. Rent may be a set cost that’s hard to change. However, spending $3 a day on a Tim Horton’s coffee is definitely something that you can reduce or cut out of your budget. Trust me, that $3 a day adds up. Once you’ve done that, you put that money that you’re saving into a high-interest or investment account and you’ll be on your way to reaching your goals!

Shameed is just a man on a mission to help those around him gain financial success. Obsessed with writing about all things finance, this GTA native is constantly learning and sharing his experiences with others.